Mathematics, 24.03.2020 01:36 macybarham

The "beta coefficient" of a stock is a measure of the stock`s volatility (or risk) relative to the market as a whole. Stocks with beta coefficients greater than 1 generally bear the greater risk (more volatility) than the market, whereas stocks with beta coefficients less than 1 are less risky (less volatile) than the overall market. A random sample of 15 high-technology stocks was selected at the end of 2009, and the sample mean and sample standard deviation of the beta coefficients were computed to be 1.23 and s=.37, respectively. (Assume that the beta coefficient follows a normal distribution.)

a. State the null and alternative hypothesis to test whether the average high-technology stock is riskier than the market as a whole.

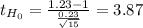

b. Establish the appropriate test statistics for this problem.

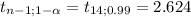

c. Determine an appropriate decision rule for testing the hypothesis in part a at the level of significance α = .01.

d. Make an appropriate conclusion based on the summary statistics provided in the problem and the decision rule you specified in part c.

e. What is the p-value of the test.

f. Based on the p-value calculated in part (e), do you reject the null hypothesis at the level of significance α=.01? Say how you made your decision.

g. How does your conclusion change if instead of α=.01 we chose a smaller level of significance? Explain.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

What properties allow transformation to be used as a problem solving tool

Answers: 1

Mathematics, 21.06.2019 17:00

Which of the symbols correctly relates the two numbers below check all that apply 6? 6

Answers: 2

Mathematics, 21.06.2019 19:30

Geometry in the diagram, ∠abc is a right angle. ∠dbc = 30°27'40". find the measure of ∠abd.

Answers: 1

You know the right answer?

The "beta coefficient" of a stock is a measure of the stock`s volatility (or risk) relative to the m...

Questions

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Chemistry, 14.05.2021 16:30

English, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Mathematics, 14.05.2021 16:30

Social Studies, 14.05.2021 16:30

Biology, 14.05.2021 16:30

Advanced Placement (AP), 14.05.2021 16:30

![t= \frac{(X[bar]-Mu)}{\frac{S}{\sqrt{n} } }~t_{n-1}](/tpl/images/0560/2077/30bc7.png)

≥ 2.624, then you reject the null hypothesis.

≥ 2.624, then you reject the null hypothesis. is greater than the critical value, the decision is to reject the null hypothesis.

is greater than the critical value, the decision is to reject the null hypothesis.