Mathematics, 19.03.2020 02:28 jacks0292

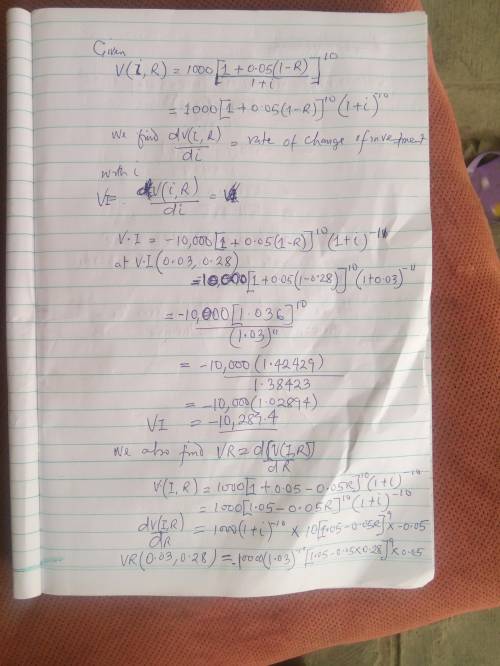

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R) 1 + I^10 where I is the annual rate of inflation and R is the tax rate for the person making the investment.

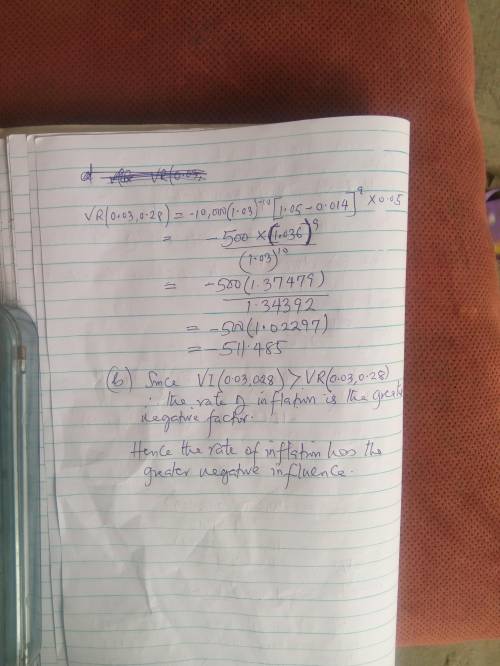

a. Calculate VI(0.03, 0.28) and VR(0.03, 0.28).

b. Determine whether the tax rate or the rate of inflation is the greater "negative" factor in the growth of the investment.

i. The rate of inflation has the greater negative influence.

ii. The tax rate has the greater negative influence

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

In triangles abc and wxy, a=w and b=x which of the following must be true to prove abc=wxy by the aas theorem? a.ab=bc b.bc=xy c.ab=wx d.

Answers: 1

Mathematics, 21.06.2019 20:00

Write the point-slope form of the line passing through (2, -12) and parallel to y=3x.

Answers: 3

Mathematics, 22.06.2019 02:00

Masons cell phone company charges $0.12 for every text message he sends plus $2.50 per month if mason sent 25 messages this month how much money does he owe the one with the correct answer and explanation gets 10 points and is marked as the brainliest answer

Answers: 1

You know the right answer?

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R)...

Questions

English, 02.09.2019 08:50

Mathematics, 02.09.2019 08:50

Mathematics, 02.09.2019 08:50

History, 02.09.2019 08:50

Computers and Technology, 02.09.2019 08:50

Health, 02.09.2019 08:50

Mathematics, 02.09.2019 08:50

Mathematics, 02.09.2019 08:50

Mathematics, 02.09.2019 08:50