Mathematics, 18.03.2020 17:58 viridianasar5158

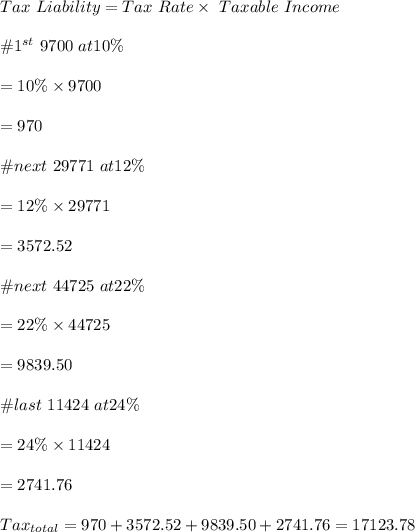

You meet that special person and get married! Amazingly, your spouse has EXACTLY the same income you do, $47,810.

If your tax status is now "married—filing jointly", what is your tax liability? Explain how you calculated this. (Remember, your income as a couple is double your individual income.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 13:00

Which of the following situations represents a linear relationship? a. theresa increases the distance she runs by 0.1 miles every week. b. the volume of a box depends on the length of box. c. the amount of money in a bank account increases by 1 percent each year. d. the population of a town doubles every 5 years.

Answers: 3

Mathematics, 21.06.2019 16:40

What is the perimeter of trapezoid jklm? + units 2 + + units 9 + units 9 + + units

Answers: 2

Mathematics, 21.06.2019 21:00

God's gym charges a sign-up fee of $100 plus $30 per month. write an expression to represent how much someone would pay for a membership.

Answers: 1

Mathematics, 21.06.2019 21:30

Are the corresponding angles congruent? explain why or why not.

Answers: 2

You know the right answer?

You meet that special person and get married! Amazingly, your spouse has EXACTLY the same income you...

Questions

German, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40

Health, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40

History, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40

Chemistry, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40

Mathematics, 11.03.2021 19:40