Mathematics, 28.02.2020 20:16 julielebo8

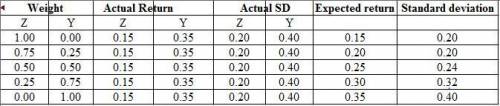

The expected returns and standard deviation of returns for two securities are as follows: Security Z Security Y Expected Return 15% 35% Standard Deviation 20% 40% The correlation between the returns is .25. (a) Calculate the expected return and standard deviation for the following portfolios: i. all in Z ii. .75 in Z and .25 in Y iii. .5 in Z and .5 in Y iv. .25 in Z and .75 in Y

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Michael is training for a marathon. in his first week he plans to run 8miles. what path should he take

Answers: 1

Mathematics, 21.06.2019 20:30

The frequency table shows the results of a survey comparing the number of beach towels sold for full price and at a discount during each of the three summer months. the store owner converts the frequency table to a conditional relative frequency table by row. which value should he use for x? round to the nearest hundredth. 0.89 0.90 0.92 0.96

Answers: 2

Mathematics, 21.06.2019 20:40

Formulate the indicated conclusion in nontechnical terms. be sure to address the original claim. the foundation chair for a hospital claims that the mean number of filled overnight beds is over 523, and she is therefore justified starting a funding campaign to add a wing to the hospital. assuming that a hypothesis test has been conducted and that the conclusion is failure to reject the null hypothesis, state the conclusion in nontechnical terms.

Answers: 3

Mathematics, 22.06.2019 03:20

Whuch statements about the diagram are true? select all that apply.

Answers: 1

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: Security Z...

Questions

Mathematics, 07.05.2020 01:12

Mathematics, 07.05.2020 01:12

Mathematics, 07.05.2020 01:12

Biology, 07.05.2020 01:12

Mathematics, 07.05.2020 01:12

Mathematics, 07.05.2020 01:12

English, 07.05.2020 01:12

Biology, 07.05.2020 01:12

Mathematics, 07.05.2020 01:12

![E (return) = [W(Z)\times E(Z)]+[W(Y)\times E(Y)]](/tpl/images/0528/3761/aa45c.png)