Mathematics, 20.02.2020 01:03 elvira18

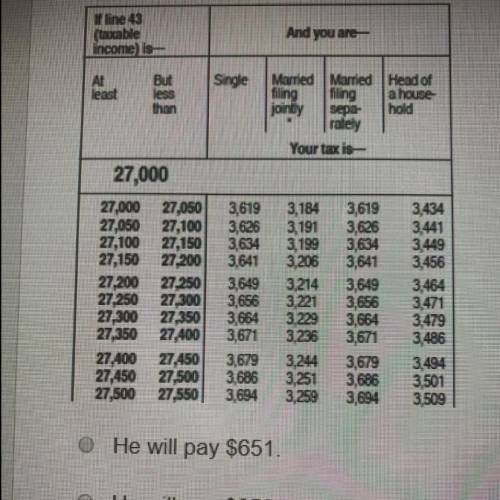

Peter's taxable income is $27,314. He is filing as single, and he has already paid $3005 in federal

taxes.

What will he receive or pay after he figures his taxes for the year?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:10

Element x decays radioactively with a half life of 8 minutes. if there are 450 grams of element x, how long, to the nearest tenth of a minute, would it take the element to decay to 37 grams?

Answers: 2

Mathematics, 21.06.2019 14:50

What is [tex] {7}^{98 + \sqrt{4} } - 3 \times (64 \div 2 + 4 - 36) \times a = a + 36[/tex]?

Answers: 3

Mathematics, 21.06.2019 22:30

Using the figure below, select the two pairs of alternate interior angles.a: point 1 and point 4 b : point 2 and point 3 c: point 6 and point 6d: point 5 and point 7

Answers: 2

Mathematics, 22.06.2019 00:30

Asalsa recipe uses green pepper, onion, and tomato in the extended ratio 3: 5: 7. how many cups of tomato are needed to make 105 cups of salsa? a. 7 b. 21 c. 35 d. 49

Answers: 3

You know the right answer?

Peter's taxable income is $27,314. He is filing as single, and he has already paid $3005 in federal<...

Questions

History, 02.09.2021 01:30

Chemistry, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Mathematics, 02.09.2021 01:30

Advanced Placement (AP), 02.09.2021 01:30

Social Studies, 02.09.2021 01:30