Than

the following federal tax table is for biweekly earnings of a single person.

if the...

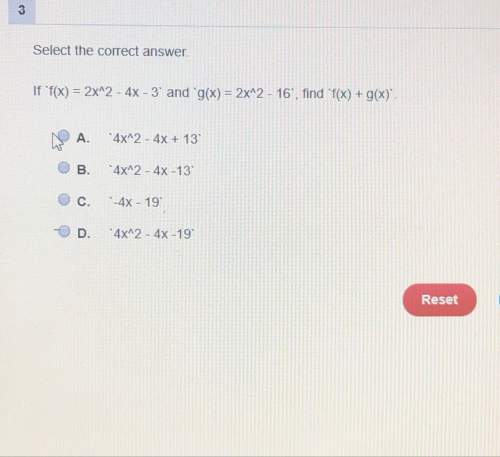

Mathematics, 22.01.2020 20:31 leilanimontes714

Than

the following federal tax table is for biweekly earnings of a single person.

if the wages are - and the number of withholding allowances claimed is -

but less 0 1 2 3 4 5 6 7 8 9 10+

at least

the amount of income tax withheld is -

720 740 62 44 26 14 1 0 0 0 0 0

740 760 65 47 28 16 3 0 0 0 0 0

760 780

31 18 5 0 0 0 0 0

780 800

34 20 7 0 0 0 0 0

800 820 92 74 37 22 9 0 0 0 0 0

820 s40 95 77 59 40 24 11 0 0 0 0 0

340 960 98 80 62 43 26 13 1 0 0 0 0

a single person earns a gross biweekly salary of $840 and claims 5 exemptions. how will federal taxes affect his net pay?

federal taxes will not affect the net pay

b. net pay will increase s11 from the gross pay.

net a decrease it from the sea

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

How to solve a simultaneous equation involved with fractions?

Answers: 1

Mathematics, 21.06.2019 22:30

For the chance to be team captain, the numbers 1-30 are put in a hat and you get two chances to pick a number, without replacement. which formula correctly shows how to find the probability that you choose the number 1 and then 2?

Answers: 1

You know the right answer?

Questions

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10

Mathematics, 01.09.2021 04:10