Mathematics, 18.01.2020 13:31 Nicolegrove7927

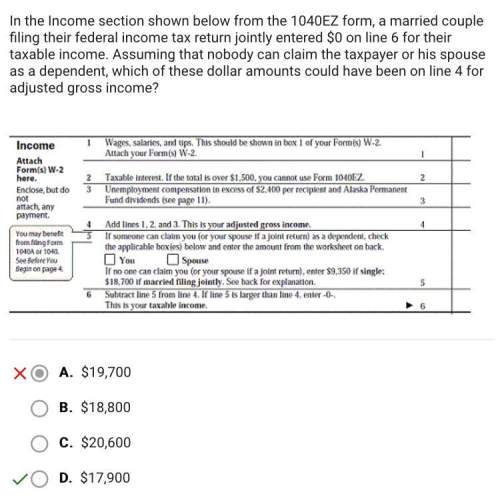

In the income section shown below from the 1040ez form, a married couple filing their federal income tax return jointly entered $0 on line 6 for their taxable income. assuming that nobody can claim the taxpayer or his spouse as a dependent, which of these dollar amounts could have been on line 4 for adjusted gross income?

$17,900

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

For the rule of 78, for a 12-month period, the last term in the sequence is 12 and the series sums to 78. for an 10 month period, the last term is and the series sum is . for a 15 month period, the last term is and the series sum is . for a 20 month period, the last term is and the series sum is

Answers: 2

Mathematics, 21.06.2019 17:10

The graph of g(x) is a translation of y = which equation represents g(x)?

Answers: 1

Mathematics, 21.06.2019 19:30

Now max recorded the heights of 500 male humans. he found that the heights were normally distributed around a mean of 177 centimeters. which statements about max’s data must be true? a) the median of max’s data is 250 b) more than half of the data points max recorded were 177 centimeters. c) a data point chosen at random is as likely to be above the mean as it is to be below the mean. d) every height within three standard deviations of the mean is equally likely to be chosen if a data point is selected at random.

Answers: 1

Mathematics, 21.06.2019 19:50

How do i simply this expression (quadratic formula basis) on a ti-84 or normal calculator?

Answers: 3

You know the right answer?

In the income section shown below from the 1040ez form, a married couple filing their federal income...

Questions

History, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50

Mathematics, 03.03.2021 16:50