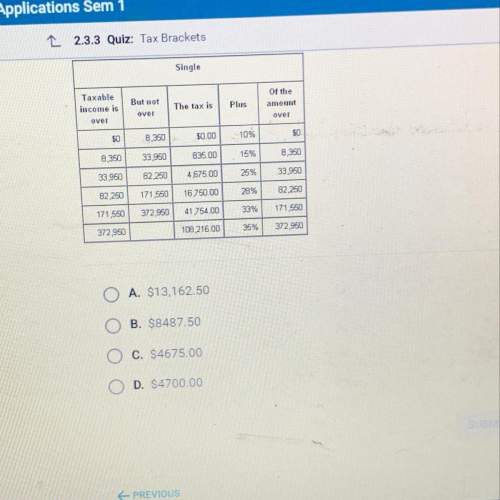

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single...

Mathematics, 16.01.2020 00:31 hugbug2554

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single filing status. using the table below find the amount he

has to pay in taxes.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:40

Find the x-intercepts of the parabola withvertex (1,1) and y-intercept (0,-3).write your answer in this form: (x1,if necessary, round to the nearest hundredth.

Answers: 1

Mathematics, 21.06.2019 18:00

How many glue sticks are in a basket containing 96 scissors, if the ratio of glue sticks to scissors is 19 to 57.

Answers: 1

Mathematics, 21.06.2019 19:20

Part a: sam rented a boat at $225 for 2 days. if he rents the same boat for 5 days, he has to pay a total rent of $480. write an equation in the standard form to represent the total rent (y) that sam has to pay for renting the boat for x days. (4 points)

Answers: 1

You know the right answer?

Questions

Mathematics, 01.04.2020 22:07

English, 01.04.2020 22:07

Mathematics, 01.04.2020 22:07

Chemistry, 01.04.2020 22:07

Mathematics, 01.04.2020 22:07

Mathematics, 01.04.2020 22:07

Chemistry, 01.04.2020 22:07

Mathematics, 01.04.2020 22:07

History, 01.04.2020 22:08

Mathematics, 01.04.2020 22:08