Mathematics, 09.01.2020 01:31 nya4657

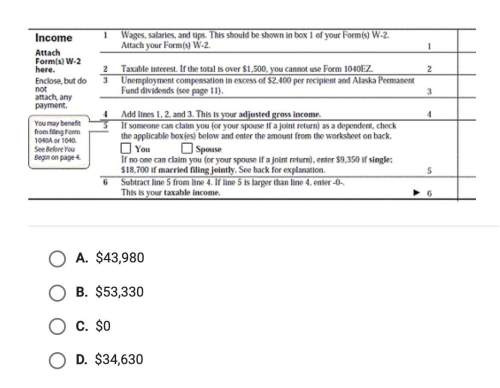

Buddie is filing his federal income tax return with the 1040ez form using the single filing status, and nobody can claim him as a dependent. if he had wages, salaries, and tips of $53,100, taxable interest of $230, and no unemployment compensation, what should he enter on line 6 of the income section below?

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:02

Abag of popcorn contains 483 calories and servers 3.5 people. how many calories are in each serving.

Answers: 1

Mathematics, 21.06.2019 15:30

Strawberries cause two hours per pound kate buys 5 pounds he gets 20% off discount on the total cost how much does kate pay for the strawberries

Answers: 3

Mathematics, 21.06.2019 17:30

Nick and nora are married and have three children in college. they have an adjusted gross income of 47,400. if their standard deduction is 12,600 itemized deductions are 14,200 and they get an exemption of 4000 for each adult and each dependent what is their taxable income

Answers: 3

Mathematics, 21.06.2019 17:30

Someone this asap for a group of students attends a basketball game. * the group buys x hot dogs at the concession stand for $2 each. * the group buys y drinks at the concession stand for $3 each. the group buys 29 items at the concession stand for a total of $70. how many hot dogs did the group buy?

Answers: 2

You know the right answer?

Buddie is filing his federal income tax return with the 1040ez form using the single filing status,...

Questions

History, 16.09.2021 21:10

English, 16.09.2021 21:10

Spanish, 16.09.2021 21:10

Spanish, 16.09.2021 21:10

Mathematics, 16.09.2021 21:10

Mathematics, 16.09.2021 21:10