Mathematics, 23.12.2019 23:31 AM28

Karen and kimo are married and file a joint return. they have two children, kay and tu, that live at home and whom they fully support. kay is 6 and tu is 8 years old. karen’s mother, ellen who is totally blind, also lives with them. ellen’s only source of income is non-taxable social security benefits. karen and kimo cover 90% of ellen’s support costs. in order for karen and kimo to both work, they pay care providers to take care of ellen all day and kay and tu after school. their total care costs for the year were: ellen $14,000, kay $4,800, and tu $4,800. during the year karen earned salary of $62,000 and kimo earned salary of $59,000. the couple do not have any other gross income or deductions for agi. calculate the dollar amount of karen and kimo’s tax credit for child and dependent care expenses. show your work including all calculations.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

With these: 18/36 = 1/? missing number change 1 5/8 to improper fraction. change 19/5 to a mixed number.

Answers: 1

Mathematics, 21.06.2019 17:00

The size of a certain cell is 2.5*10^-9m. another cell is 1.5*10^3 times larger. how large is the larger cell in scientific notation?

Answers: 2

Mathematics, 21.06.2019 18:00

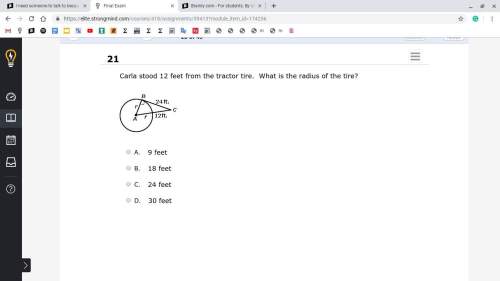

The center of the circumscribed circle lies on line segment and the longest side of the triangle is equal to the of the circle.

Answers: 2

Mathematics, 21.06.2019 21:00

Rewrite the following quadratic functions in intercept or factored form. show your work. f(x) = 3x^2 - 12

Answers: 1

You know the right answer?

Karen and kimo are married and file a joint return. they have two children, kay and tu, that live at...

Questions

Mathematics, 05.01.2021 22:50

English, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

English, 05.01.2021 22:50

Arts, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Advanced Placement (AP), 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Mathematics, 05.01.2021 22:50

Biology, 05.01.2021 22:50

Health, 05.01.2021 22:50