Mathematics, 21.12.2019 07:31 zhenhe3423

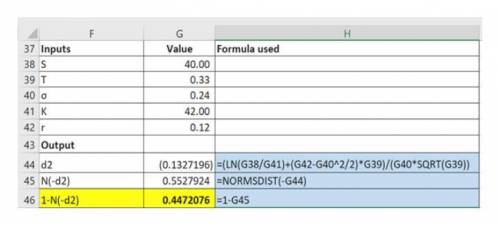

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 and the volatility parameter σ = 0.24.

(a) if the current price of the security is $40, find the probability that a call option, having four months until expiration and with a strike price of k = 42 will be exercised.

(b) in addition to the above information as in part (a) if the interest rate is 8%, find the risk-neutral arbitrage free valuation of the call option.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:40

Which graph represents the following piecewise defined function?

Answers: 2

Mathematics, 21.06.2019 18:00

What is the relationship between all triangles that can be drawn given the same three angles

Answers: 2

Mathematics, 21.06.2019 20:00

Select the number of ways in which a line and a circle can intersect

Answers: 3

You know the right answer?

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 an...

Questions

Social Studies, 18.03.2021 18:10

World Languages, 18.03.2021 18:10

English, 18.03.2021 18:10

Biology, 18.03.2021 18:10

History, 18.03.2021 18:10

Mathematics, 18.03.2021 18:10

Social Studies, 18.03.2021 18:10