Mathematics, 30.11.2019 05:31 mzbugsbunny3029

Consider a derivative whose payoff at expiration is s 2 t + 1 if st < 100 and s 2 t + st − 100 if st ≥ 100. assuming the volatility is σ, the riskfree rate r, and the spot price s0, compute the price of this derivative today. hint: write the derivative as 3 derivatives (a power option, an option and a digital option) and price each separately.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 12:50

Nnnnneeedd 1.find the residual if you know the actual number is 5.2 and the predicted value is 4.8

Answers: 3

Mathematics, 21.06.2019 16:50

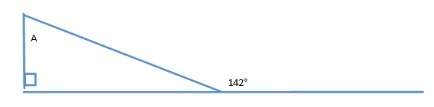

The vertices of a triangle are a(7,5), b(4,2), c(9,2). what is m

Answers: 2

Mathematics, 21.06.2019 19:50

If your teacher tells you to do questions 6 through 19 in your math book for homework, how many questions is that

Answers: 1

Mathematics, 21.06.2019 22:00

Consider the triangle. which shows the order of the angles from smallest to largest? angle a, angle b, angle c angle b, angle a, angle c angle b, angle c, angle a angle c, angle a, angle b

Answers: 3

You know the right answer?

Consider a derivative whose payoff at expiration is s 2 t + 1 if st < 100 and s 2 t + st − 100 i...

Questions

Computers and Technology, 09.07.2019 09:30

Spanish, 09.07.2019 09:30

English, 09.07.2019 09:30

Mathematics, 09.07.2019 09:30

Chemistry, 09.07.2019 09:30

Mathematics, 09.07.2019 09:30

Biology, 09.07.2019 09:30

Chemistry, 09.07.2019 09:30

Mathematics, 09.07.2019 09:30

History, 09.07.2019 09:30

English, 09.07.2019 09:30

Biology, 09.07.2019 09:30