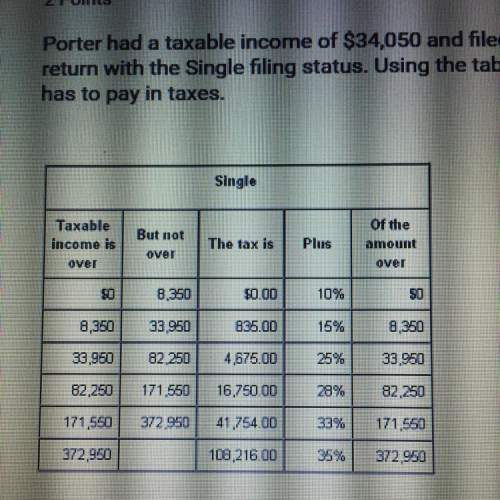

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single...

Mathematics, 12.11.2019 03:31 beccakubas

Porter had a taxable income of $34,050 and filed his federal income tax

return with the single filing status. using the table below find the amount he

has to pay in taxes.

a. $8487.50

b. $4675.00

c. $13,162.50

d. $4700.00

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:02

Factor completely. x^8 - 1/81 a) (x^4 + 1/9)(x^2 + 1/3)(x^2 - 1/3) b) (x^4 - 1/9)(x^2 + 1/3)(x^2 - 1/3) c) (x^4 + 1/9)(x^2 - 1/3)2

Answers: 3

Mathematics, 21.06.2019 15:40

What is the first quartile of the data set? 10, 11, 12, 15, 17, 19, 22, 24, 29, 33, 38 a. 12 b. 19 c. 29 d. 10

Answers: 1

Mathematics, 21.06.2019 16:30

You are making a blueprint of your bedroom and you plan to use a scale factor of 18 . the actual width of your room is 14 feet and the actual length of your room is 16 feet. determine the width and length of your room on the blueprint. on the blueprint, your room will have a width of feet and a length of feet.

Answers: 2

Mathematics, 21.06.2019 22:10

In which direction does the left side of the graph of this function point? f(x) = 3x3 - x2 + 4x - 2

Answers: 2

You know the right answer?

Questions

Arts, 08.05.2021 02:00

Mathematics, 08.05.2021 02:00

Mathematics, 08.05.2021 02:00

History, 08.05.2021 02:00

Mathematics, 08.05.2021 02:00

History, 08.05.2021 02:00

Health, 08.05.2021 02:00

Mathematics, 08.05.2021 02:00

History, 08.05.2021 02:00