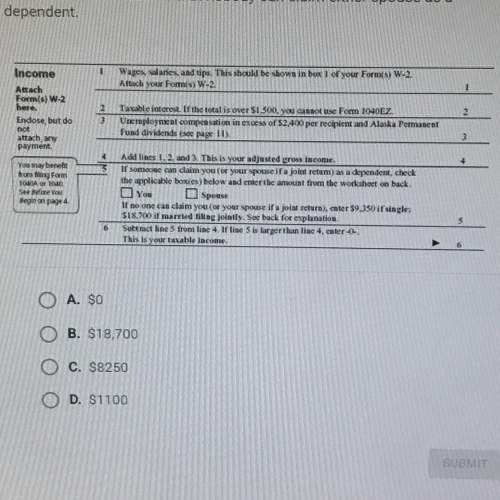

According to the income section shown below from the 1040ez form, in

married couple filing the...

Mathematics, 08.11.2019 19:31 cjdolce9790

According to the income section shown below from the 1040ez form, in

married couple filing their federal income tax return jointly enters 817,600 on

line 4 for adjusted gross income, what would they enter on line 6 for their

taxable income? assume that nobody can claim either spouse as a

dependent

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Steve had 48 chocolates but he decided to give 8 chocolats to each of his f coworkers. how many chocolates does steve have left

Answers: 1

Mathematics, 21.06.2019 21:00

Glenda makes an online purchase for picture frames for $12.95 each and formats of $5.89 each the site says it taxes paid by the customer or 6.5% of the total purchase price shipping charges are based on the

Answers: 1

You know the right answer?

Questions

Mathematics, 11.07.2019 06:00

Mathematics, 11.07.2019 06:00

Biology, 11.07.2019 06:00

Chemistry, 11.07.2019 06:10

Social Studies, 11.07.2019 06:10

Mathematics, 11.07.2019 06:10

Mathematics, 11.07.2019 06:10

Mathematics, 11.07.2019 06:10