Mathematics, 16.10.2019 05:00 aliw03

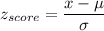

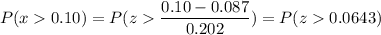

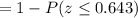

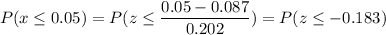

Andrew plans to retire in 40 years. he plans to invest part of his retirement funds in stocks, so he seeks out information on past returns. he learns that over the entire 20th century, the real (that is, adjusted for inflation) annual returns on u. s. common stocks had mean 8.7% and standard deviation 20.2%. the distribution of annual returns on common stocks is roughly symmetric, so the mean return over even a moderate number of years is close to normal. what is the probability (assuming that the past pattern of variation continues) that the mean annual return on common stocks over the next 40 years will exceed 10%? what is the probability that the mean return will be less than 5%? write a conclusion in the context of the problem.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

What is the answer to this question? i'm a bit stumped. also how do i do it? 5(x - 4) = 2(x + 5)

Answers: 1

Mathematics, 21.06.2019 20:30

Asunflower was 20 1/2 inches tall. over the next 6 months, it grew to a height of 37 inches tall. what was the average yearly growth rate of the height of the plzzz write a proportion i will give you 100 points

Answers: 1

Mathematics, 22.06.2019 03:30

Given the equation −4 = 12, solve for x and identify if it is an extraneous solution.

Answers: 1

Mathematics, 22.06.2019 04:20

What is the range of the inverse of the given function f(x)=√x-2

Answers: 2

You know the right answer?

Andrew plans to retire in 40 years. he plans to invest part of his retirement funds in stocks, so he...

Questions

Geography, 27.10.2021 18:20

History, 27.10.2021 18:20

Biology, 27.10.2021 18:20

Mathematics, 27.10.2021 18:20

Mathematics, 27.10.2021 18:20

Mathematics, 27.10.2021 18:20

Mathematics, 27.10.2021 18:20

Social Studies, 27.10.2021 18:20