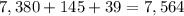

Annual rent $ 7,380

insurance 145

security deposit 650

annual mortgage payments $9...

Mathematics, 20.09.2019 20:10 gmedisa08

Annual rent $ 7,380

insurance 145

security deposit 650

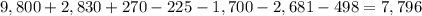

annual mortgage payments $9,800 ($9,575 is interest)

property taxes 1,780

insurance/maintenance 1,050

down payment/closing costs 4,500 growth in equity 225

estimated annual appreciation 1,700

assume an after-tax savings interest rate of 6 percent and a tax rate of 28 percent.

a) calculate the total rental cost and total buying cost. (round your intermediate calculations and final answers to the nearest whole number.)

b) would you recommend buying or renting?

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:04

7friends share 4 pizzas equally how much pizza did each friend get

Answers: 1

Mathematics, 21.06.2019 18:00

What is the value of x in the equation (2)3) (x+6)= -18 a. -36 b. -33 c. -24 d. -18

Answers: 1

Mathematics, 21.06.2019 21:00

At oaknoll school, 90 out of 270 students on computers. what percent of students at oak knoll school do not own computers? round the nearest tenth of a percent.

Answers: 1

You know the right answer?

Questions

Biology, 14.08.2020 14:01

Mathematics, 14.08.2020 14:01

Mathematics, 14.08.2020 14:01

Mathematics, 14.08.2020 14:01

Geography, 14.08.2020 14:01

Chemistry, 14.08.2020 14:01

= $2830

= $2830 dollars

dollars dollars

dollars