Mathematics, 14.09.2019 05:30 cerna

You are considering the choice between investing $50,000 in a conventional 1-year bank cd offering an interest rate of 5% and a 1-year "inflation-plus" cd offering 1.5% per year plus the rate of inflation. a. which is the safer investment? b. can you tell which offers the higher expected return? c. if you expect the rate of inflation to be 3% over the next year, which is the better investment? why? d. if we observe a risk-free nominal interest rate of 5% per year and a risk-free real rate of 1.5% on inflation-indexed bonds, can we infer that the market's expected rate of inflation is 3.5% per year?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

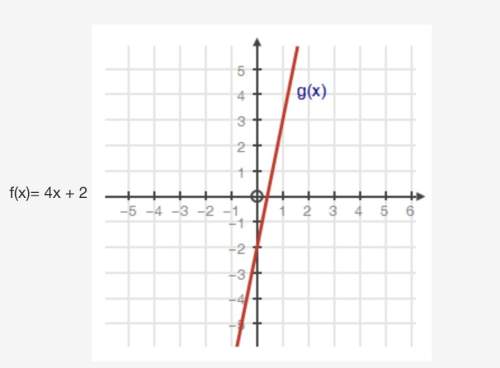

Aline passes through 3,7 and 6,9 what equation represents the line

Answers: 2

Mathematics, 21.06.2019 22:30

The dash figure is a dilation if the original figure. find the scale factor. classify the dilation as an enlargement or a reduction

Answers: 2

Mathematics, 21.06.2019 23:00

Apackage of orgainc strwberries costs $1.50 while there in season and $2.25 when not in season what the percent increase

Answers: 1

You know the right answer?

You are considering the choice between investing $50,000 in a conventional 1-year bank cd offering a...

Questions

Geography, 16.06.2020 10:57

Chemistry, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57

History, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57

Biology, 16.06.2020 10:57

Biology, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57

Engineering, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57

Mathematics, 16.06.2020 10:57