Net present value. quark industries has a project with the following projected cash flows:

in...

Mathematics, 18.07.2019 19:20 dad46

Net present value. quark industries has a project with the following projected cash flows:

initial cost:

$220,000

cash flow year one:

$22,000

cash flow year two:

$78,000

cash flow year three:

$160,000

cash flow year four:

$160,000

a. using a discount rate of 10% for this project and the npv model, determine whether the company should accept or reject this project.

b. should the company accept or reject it using a discount rate of 16%?

c. should the company accept or reject it using a discount rate of 21%?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:00

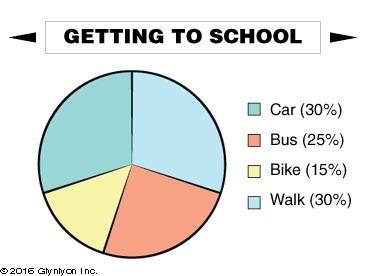

What value of x will make the triangles similar by the sss similarity theorem?

Answers: 3

Mathematics, 21.06.2019 21:00

Choose the equation that represents the graph below: (1 point) graph of a line passing through points negative 3 comma 0 and 0 comma 3 y = x − 3 y = −x + 3 y = −x − 3 y = x + 3 will award !

Answers: 3

Mathematics, 21.06.2019 22:00

Onnie is considering doing some long term investing with money that she inherited. she would like to have $50,000 at the end of 30 years. approximately how much money would lonnie need to put into an account earning 6% interest compounded annually in order to meet her goal?

Answers: 1

You know the right answer?

Questions

English, 31.07.2020 18:01

Health, 31.07.2020 18:01

History, 31.07.2020 18:01

Mathematics, 31.07.2020 18:01

Mathematics, 31.07.2020 18:01

Mathematics, 31.07.2020 18:01

English, 31.07.2020 18:01

Spanish, 31.07.2020 18:01

Mathematics, 31.07.2020 18:01

Mathematics, 31.07.2020 18:01