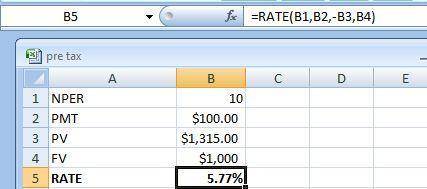

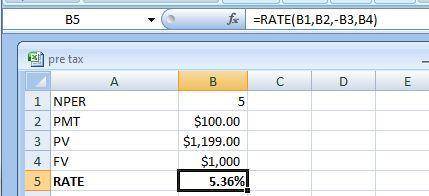

This question illustrates the effects of time to maturity on a bond’s yield to maturity. Tindall Enterprises has two outstanding bonds. Both bonds are risk-fee, both pay 10.00% annual coupons, both have face values of 1000, and both bonds just made a coupon payment; however, bond A matures in 10 years and bond B matures in 5 years. Given that the price of bond A is $ 1,315 and the price of bond B is $ 1,199, how much bigger is the yield-to-maturity of bond A than the yield-to-maturity of bond B? Enter your answer as a perecent without the "%"; round your final answer to two decimals

Answers: 1

Another question on Chemistry

Chemistry, 22.06.2019 00:30

Water (2510 g ) is heated until it just begins to boil. if the water absorbs 5.09×105 j of heat in the process, what was the initial temperature of the water?

Answers: 3

Chemistry, 23.06.2019 00:00

#20 which type of bond is formed when bases pair in dna? ionic bond covalent bond coordinate bond hydrogen bond

Answers: 1

Chemistry, 23.06.2019 18:00

Which action would reduce the activation energy of a chemical reaction? a. adding a catalyst to the reaction b. adding more reactants to the reaction vessel c. lowering the potential energy of the products d. lowering the potential energy of the reactants e. raising the temperature of the reaction

Answers: 1

You know the right answer?

This question illustrates the effects of time to maturity on a bond’s yield to maturity. Tindall Ent...

Questions

Mathematics, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Engineering, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

SAT, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Social Studies, 10.11.2020 23:30

English, 10.11.2020 23:30

Mathematics, 10.11.2020 23:30

Physics, 10.11.2020 23:30