Amachine costs $1,000 and has a 3-year life. the estimated salvage value at the end of three years is $100. the project is expected to generate after tax-cash flows of $600 per year. if the required rate of return is 10%, what is the npv of the project? (do not round intermediate computations. round final answer to the nearest whole number.)

Answers: 1

Another question on Business

Business, 21.06.2019 13:10

At the end of the year, blossom co. has pretax financial income of $561,000. included in the $561,000 is $73,000 interest income on municipal bonds, $25,000 fine for dumping hazardous waste, and depreciation of $64,400. depreciation for tax purposes is $48,300. compute income taxes payable, assuming the tax rate is 30% for all periods.

Answers: 2

Business, 22.06.2019 06:30

Double corporation acquired all of the common stock of simple company for

Answers: 2

Business, 22.06.2019 20:00

Edna gomez is the founder of the restaurant chain good and green. she ensures that the products in her stores are ethically and responsibly sourced. most products are therefore 100 percent organic and all packaging is manufactured from recycled material. also, her company sources ingredients from farms within 100 miles from her locations. edna's belief is that her restaurants should be able to support the community at large. which of the following terms best describes edna gomez? a. headhunter b. category captain c. social entrepreneur d. trade creditor

Answers: 3

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

You know the right answer?

Amachine costs $1,000 and has a 3-year life. the estimated salvage value at the end of three years i...

Questions

Chemistry, 01.07.2020 15:01

Physics, 01.07.2020 15:01

Mathematics, 01.07.2020 15:01

Physics, 01.07.2020 15:01

=

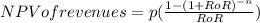

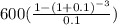

=  = $1,492.11

= $1,492.11 )=

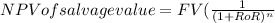

)=  = $75.13

= $75.13