Business, 22.07.2019 17:00 lwilhite33105

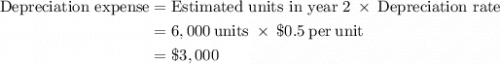

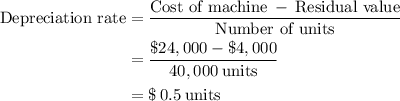

Mohr company purchases a machine at the beginning of the year at a cost of $24,000. the machine is depreciated using the units-of-production method. the company estimates it will use the machine for 5 years, during which time it anticipates producing 40,000 units. the machine is estimated to have a $4,000 salvage value. the company produces 9,000 units in year 1 and 6,000 units in year 2. depreciation expense in year 2 is:

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

In a macroeconomic context, what are implicit liabilities? money owed to people possessing government issued bonds. the amount of money that firms collectively owe to shareholders. money that the government has promised to pay in the future. payments that the federal government undertakes only during periods of recession. which of the choices is a significant implicit liability in the united states? military spending education spending national science foundation spending social security

Answers: 2

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 15:00

Oerstman, inc. uses a standard costing system and develops its overhead rates from the current annual budget.the budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours.(practical capacity is 500,000 hours)annual budgeted overhead costs total $772,800, of which $556,800 is fixed overhead.a total of 119,300 units, using 478,000 direct labor hours, were produced during the year.actual variable overhead costs for the year were $260,400 and actual fixed overhead costs were $555,450.required: 1. compute the fixed overhead spending variance and indicate if favorable or unfavorable.2. compute the fixed overhead volume variance and indicate if favorable or unfavorable.

Answers: 3

You know the right answer?

Mohr company purchases a machine at the beginning of the year at a cost of $24,000. the machine is d...

Questions

Mathematics, 03.06.2021 16:30

Mathematics, 03.06.2021 16:30

Chemistry, 03.06.2021 16:30

Mathematics, 03.06.2021 16:30

Social Studies, 03.06.2021 16:30

Mathematics, 03.06.2021 16:30

Physics, 03.06.2021 16:30

Chemistry, 03.06.2021 16:30

Mathematics, 03.06.2021 16:30

Mathematics, 03.06.2021 16:30