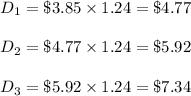

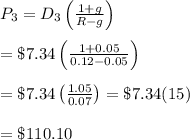

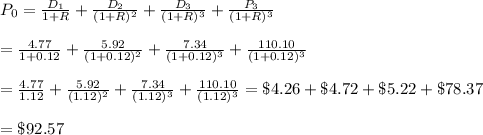

Synovec co. is growing quickly. dividends are expected to grow at a rate of 24 percent for the next three years, with the growth rate falling off to a constant 5 percent thereafter. if the required return is 12 percent, and the company just paid a dividend of $3.85, what is the current share price?

Answers: 1

Another question on Business

Business, 22.06.2019 04:40

Select the correct answerwhat is the responsibility of each of the twelve federal reserve's banks in their districts? a.they set the prime rateob.they monitor functioning of banks in their through onsite and offsite reviewsc.they assess taxes in their destnictd.they write fiscal policies

Answers: 1

Business, 22.06.2019 20:00

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

Business, 22.06.2019 21:30

Which is the most compelling reason why mobile advertising is related to big data?

Answers: 1

You know the right answer?

Synovec co. is growing quickly. dividends are expected to grow at a rate of 24 percent for the next...

Questions

Mathematics, 21.11.2020 01:10

History, 21.11.2020 01:10

Computers and Technology, 21.11.2020 01:10

English, 21.11.2020 01:10

Mathematics, 21.11.2020 01:10

Social Studies, 21.11.2020 01:10

Mathematics, 21.11.2020 01:10

Mathematics, 21.11.2020 01:10