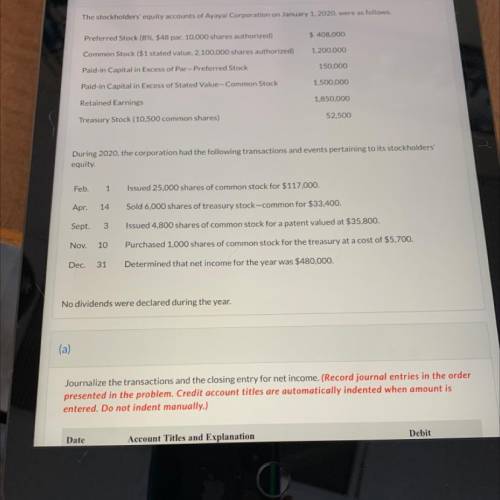

The stockholders’ equity accounts of Ayayai Corporation on January 1, 2020, were as follows.

Preferred Stock (8%, $48 par, 10,000 shares authorized) $ 408,000

Common Stock ($1 stated value, 2,100,000 shares authorized) 1,200,000

Paid-in Capital in Excess of Par—Preferred Stock 150,000

Paid-in Capital in Excess of Stated Value—Common Stock 1,500,000

Retained Earnings 1,850,000

Treasury Stock (10,500 common shares) 52,500

During 2020, the corporation had the following transactions and events pertaining to its stockholders’ equity.

Feb.1 Issued 25,000 shares of common stock for $117,000.

Apr.14 Sold 6,000 shares of treasury stock—common for $33,400.

Sept.3 Issued 4,800 shares of common stock for a patent valued at $35,800.

Nov.10 Purchased 1,000 shares of common stock for the treasury at a cost of $5,700.

Dec.31 Determined that net income for the year was $480,000.

No dividends were declared during the year.

(a)

Journalize the transactions and the closing entry for net income. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Resources and capabilities, such as interpersonal relations among managers and a firm's culture, that may be costly to imitate because they are beyond the ability of firms to systematically manage and influence are referred to asanswers: socially complex.causally ambiguous.path dependent.the result of unique historical conditions.

Answers: 3

Business, 22.06.2019 19:00

When making broccoli cream soup, the broccoli and aromatics should be a. burned. b. simmered. c. puréed. d. sweated.

Answers: 2

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

You know the right answer?

The stockholders’ equity accounts of Ayayai Corporation on January 1, 2020, were as follows.

Prefe...

Questions

Chemistry, 29.01.2020 16:06

Social Studies, 29.01.2020 16:06

Health, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Social Studies, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Chemistry, 29.01.2020 16:06

Geography, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Geography, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06

Mathematics, 29.01.2020 16:06