Business, 09.02.2022 17:10 nikeahbrown

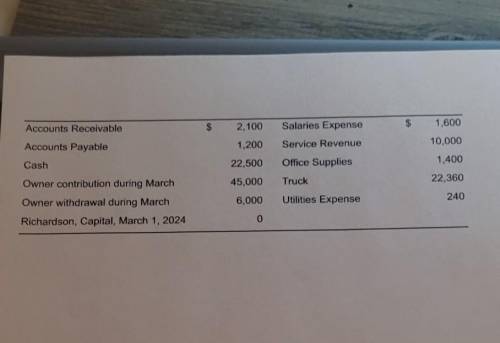

Using the following information, complete the income statement, statement of owner's equity, and balance sheet for MJ painting for the month of March 2024. The business began operations on March 1, 2024. (Click the icon to view the account balances.) Begin by preparing the income statement for MJ Painting for the month of March 2024. (If a box is not used in the table, leave the box empty; do not select a label or enter a zero.) का Net Income Clear all Check answer Etext pages Calculator Ask my instructor resume

Answers: 2

Another question on Business

Business, 21.06.2019 18:50

Which of the following is not a potential problem with beta and its estimation? sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta. the beta of "the market," can change over time, sometimes drastically.

Answers: 3

Business, 21.06.2019 20:20

On february 3, smart company sold merchandise in the amount of $5,800 to truman company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. smart uses the perpetual inventory system and the gross method. truman pays the invoice on february 8, and takes the appropriate discount. the journal entry that smart makes on february 8 is:

Answers: 3

Business, 21.06.2019 20:40

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 22.06.2019 05:30

The struter partnership has total partners’ equity of $510,000, which is made up of main, capital, $400,000, and frist, capital, $110,000. the partners share net income and loss in a ratio of 80% to main and 20% to frist. on november 1, adison is admitted to the partnership and given a 15% interest in equity and a 15% share in any income and loss. prepare journal entries to record the admission of adison for a 15% interest in the equity and a 15% share in any income and loss under the following independent assumptions. (1) record the admission of adison with an investment of $90,000 for a 15% interest in the equity and a 15% share in any income and loss. (2) record the admission of adison with an investment of $120,000 for a 15% interest in the equity and a 15% share in any income and loss. (3) record the admission of adison with an investment of $80,000 for a 15% interest in the equity and a 15% share in any income and loss.

Answers: 1

You know the right answer?

Using the following information, complete the income statement, statement of owner's equity, and bal...

Questions

Mathematics, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

Social Studies, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

Mathematics, 29.01.2021 19:50

English, 29.01.2021 19:50

Mathematics, 29.01.2021 20:00