Business, 06.02.2022 14:00 piggygirl211

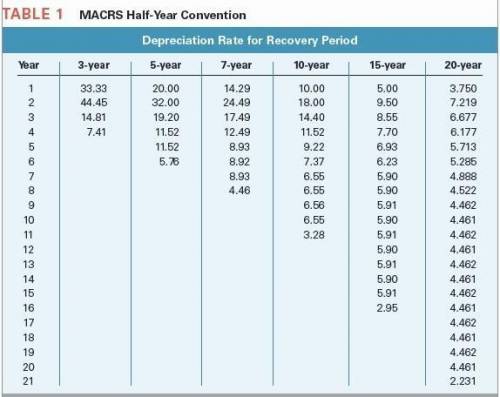

A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be required. The project is replacing old equipment that can be sold for $25,000, book value 0. Assume that the equipment will be depreciated as a 3-year asset under MACRS. The useful life is 5 years with a 40% tax rate.

a. What is the NINV for the project? Calculate the depreciation for each of the 5 years of the asset’s life.

b. Assume the FCF for the project is $95,000 per year for 5 years. Calculate the NPV, IRR, MIRR, and PI for the project if your required discount rate is 12%?

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

Sonic corp. manufactures ski and snowboarding equipment. it has estimated that this year there will be substantial growth in its sales during the winter months. it approaches the bank for credit. what is the purpose of such credit known as? a. expansion b. inventory building c. debt management d. emergency maintenance

Answers: 1

Business, 22.06.2019 08:30

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 16:40

Determining effects of stock splits oracle corp has had the following stock splits since its inception. effective date split amount october 12, 2000 2 for 1 january 18, 2000 2 for 1 february 26, 1999 3 for 2 august 15, 1997 3 for 2 april 16, 1996 3 for 2 february 22, 1995 3 for 2 november 8, 1993 2 for 1 june 16,1989 2 for 1 december 21, 1987 2 for 1 march 9, 1987 2 for 1 a. if the par value of oracle shares was originally $2, what would oracle corp. report as par value per share on its 2015 balance sheet? compute the revised par value after each stock split. round answers to three decimal places.

Answers: 1

You know the right answer?

A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be...

Questions

Biology, 02.03.2020 06:12

Biology, 02.03.2020 06:12

Mathematics, 02.03.2020 06:12

Physics, 02.03.2020 06:13

Mathematics, 02.03.2020 06:13

Mathematics, 02.03.2020 06:13

Mathematics, 02.03.2020 06:13

English, 02.03.2020 06:15

Social Studies, 02.03.2020 06:16

Mathematics, 02.03.2020 06:20