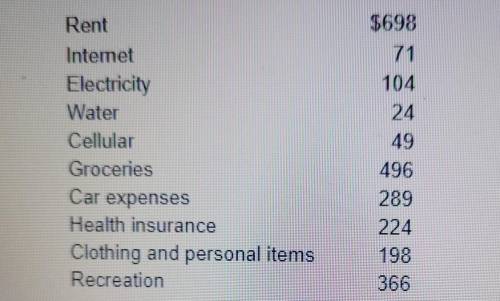

angela's disposal income $2,861. angela inspects her checkbook and her credit card bills and determines that she has the following monthly expenses. what is angela's net cash flow. ( round to the nearest dollar . enter a positive number for net cash inflow and a negative number for cash out flow .

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Insurance companies have internal controls in place to protect assets, monitor the accuracy of accounting records and encourage operational efficiencies and adherence to policies. these internal controls are generally of two types: administrative controls and accounting controls. administrative controls are the policies and procedures that guide the daily actions of employees. accounting controls are the policies and procedures that delineate authorizations of financial transactions that are done, safeguard assets, and provide reports on the company’s financial status in a reliable and timely manner. internal controls should include both preventative and detective controls. the purpose of preventative controls is to stop problems and errors before they occur. detective controls identify problems after they have occurred. preventative controls are usually more effective at reducing problems, but they also tend to be more expensive. internal controls must be flexible to adjust for changes in laws and regulations in addition to adding new products or modifying current ones. companies must also do regular analyses to ensure that the benefits of implementing the controls are worth their costs. when concerned about paying unwarranted insurance claims which type of control would be useful?

Answers: 2

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 22:40

Rolston music company is considering the sale of a new sound board used in recording studios. the new board would sell for $27,200, and the company expects to sell 1,570 per year. the company currently sells 2,070 units of its existing model per year. if the new model is introduced, sales of the existing model will fall to 1,890 units per year. the old board retails for $23,100. variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,520,000 per year, and fixed costs are $1,420,000 per year.if the tax rate is 35 percent, what is the annual ocf for the project?

Answers: 1

Business, 22.06.2019 23:00

To increase sales, robert sends out a newsletter to his customers each month, letting them know about new products and ways in which to use them. in order to protect his customers' privacy, he uses this field when addressing his e-mail. attach bcc forward to

Answers: 2

You know the right answer?

angela's disposal income $2,861. angela inspects her checkbook and her credit card bills and determi...

Questions

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Biology, 10.09.2020 17:01

Chemistry, 10.09.2020 17:01

English, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

World Languages, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01

English, 10.09.2020 17:01

Mathematics, 10.09.2020 17:01