SEE ATTACHMENTS

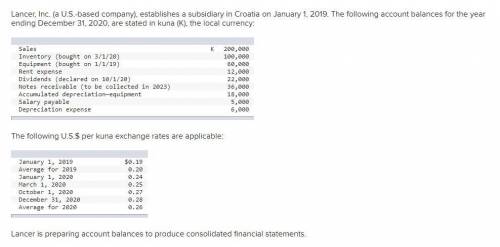

Lancer, Inc. (a U. S.-based company), establishes a subsidiary in Croatia on January 1, 2019. The following account balances for the year ending December 31, 2020, are stated in kuna (K), the local currency:

Sales K 200,000

Inventory (bought on 3/1/20) 100,000

Equipment (bought on 1/1/19) 60,000

Rent expense 12,000

Dividends (declared on 10/1/20) 22,000

Notes receivable (to be collected in 2023) 36,000

Accumulated depreciation—equipment 18,000

Salary payable 5,000

Depreciation expense 6,000

The following U. S.$ per kuna exchange rates are applicable:

January 1, 2019 $0.19

Average for 2019 0.20

January 1, 2020 0.24

March 1, 2020 0.25

October 1, 2020 0.27

December 31, 2020 0.28

Average for 2020 0.26

Lancer is preparing account balances to produce consolidated financial statements.

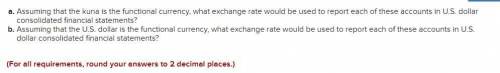

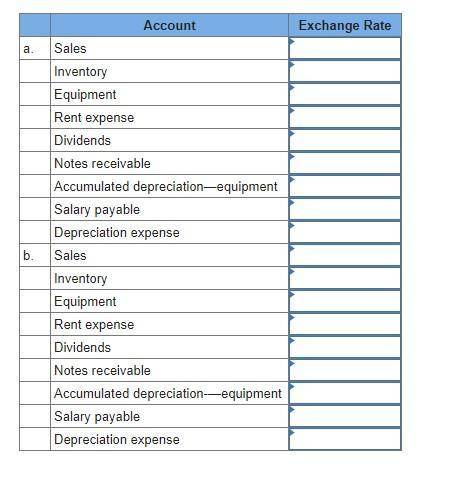

Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in U. S. dollar consolidated financial statements?

Assuming that the U. S. dollar is the functional currency, what exchange rate would be used to report each of these accounts in U. S. dollar consolidated financial statements?

(For all requirements, round your answers to 2 decimal places.)

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Long-distance providers are becoming increasingly concerned about certain activities within their industry. various companies come together voluntarily to implement new standards of social responsibility that members must abide by. what seems to be the primary motivation in this case for an increased interest in social responsibility? - because corporations are creations of society, they are responsible for giving back to the communities in which they operate.- these companies have realized it is in their best interest to increase their social responsibility before they are once again subject to stricter regulations.- these companies are using social responsibility as a means to increase their profitability, both short term and long term.- long-distance providers have started taking pride in their industry and its record for social responsibility.- they feel a responsibility to their stockholders, employees, the government, investors, and society as a whole.

Answers: 2

Business, 21.06.2019 22:20

If you offer up your car as a demonstration that you will pay off your loan to a bank or another financial lending institution, you are using your car as collateral. true false

Answers: 2

Business, 22.06.2019 04:30

What is the second step in communication planning? determine the purpose of the message outline the communication for delivery determine the best channel of communication clarify objectives identify the audience

Answers: 2

Business, 22.06.2019 13:50

Selected t-account balances for bloomfield company are shown below as of january 31, which reflect its accounting adjustments. the firm uses a calendar-year accounting period, but prepares monthly accounting adjustments.suppliesjan. 31 bal. 1,800 1,800 jan. 31 bal.supplies expensejan. 31 bal. 1,920 1,148 jan. 31 bal.prepaid insurancejan. 31 bal. 1,148 1,148 jan. 31 bal.insurance expensejan. 31 bal. 164 164 jan. 31 bal.wages payablejan. 31 bal. 1,400 1,400 jan. 31 bal.wages expensejan. 31 bal. 6,400 6,400 jan. 31 bal.truckjan. 31 bal. 17,376 17,376 jan. 31 bal.accumulated depreciation -truckjan. 31 bal. 5,068 5,068 jan. 31 bal.a. if the amount in supplies expense represents the january 31 adjustment for the supplies used in january, and $1,240 worth of supplies were purchased during january, what was the january 1 beginning balance of supplies? $answerb. the amount in the insurance expense account represents the adjustment made at january 31 for january insurance expense. if the original insurance premium was for one year, what was the amount of the premium, and on what date did the insurance policy start? amount of the premium $answerthe policy began on answerjune 1july 1august 1september 1october 1november 1 of the previous year.c. if we assume that no beginning balance existed in either in either wage payable or wage expense on january 1, how much cash was paid as wages during january? $answerd. if the truck has a useful life of four years (or 48 months), what is the monthly amount of depreciation expense, and how many months has bloomfield owned the truck? answermonths

Answers: 1

You know the right answer?

SEE ATTACHMENTS

Lancer, Inc. (a U. S.-based company), establishes a subsidiary in Croatia on Janua...

Questions

Geography, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Advanced Placement (AP), 22.01.2021 07:40

English, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Advanced Placement (AP), 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Mathematics, 22.01.2021 07:40

Social Studies, 22.01.2021 07:40