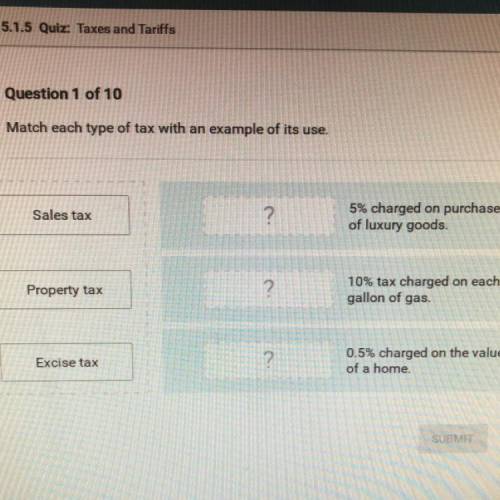

Match each type of tax with an example of its use.

2

5% charged on purchases

of luxury...

Business, 26.10.2021 01:50 madiiiiiii69

Match each type of tax with an example of its use.

2

5% charged on purchases

of luxury goods.

Sales tax

?

10% tax charged on each

gallon of gas.

Property tax

?

0.5% charged on the value

of a home

Excise tax

Answers: 3

Another question on Business

Business, 23.06.2019 02:30

Match each definition in column 1 with a vocabulary word from column 2." some of the entries in column 2 do not apply costs which do not change with the level of output costs which change with the level of output the change in total costs resulting from an increase in output by one unit function showing the quantities of a particular good demanded at a range of price when the quantity supplied of a good is greater than the quantity demanded when the quantity demanded for a particular good is greater than the quantity supplied the price and quantity determined in a market when the supply equals the demand when revenue exceeds costs when costs exceeds revenue output where revenue = costs

Answers: 1

Business, 23.06.2019 06:00

If a society decides to produce consumer goods from its available resources, it is answering the basic economic question

Answers: 3

Business, 23.06.2019 06:30

Afinance company wants to upgrade its accounting software to a higher version. this version change requires a change in data formats. which method represents a change in data formats?

Answers: 1

Business, 23.06.2019 14:00

If china enforces the software procurement regulation, the most likely result is

Answers: 1

You know the right answer?

Questions

Mathematics, 18.07.2019 22:30

Social Studies, 18.07.2019 22:30

History, 18.07.2019 22:30

English, 18.07.2019 22:30

Mathematics, 18.07.2019 22:30

Mathematics, 18.07.2019 22:30