Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold from wages.

Here is the question: Cal is married and has 4 withholding allowances. His semi-monthly salary is $2480.

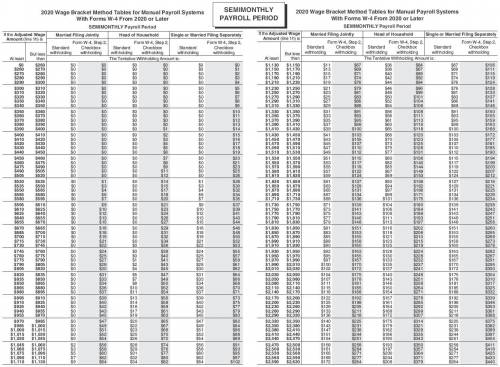

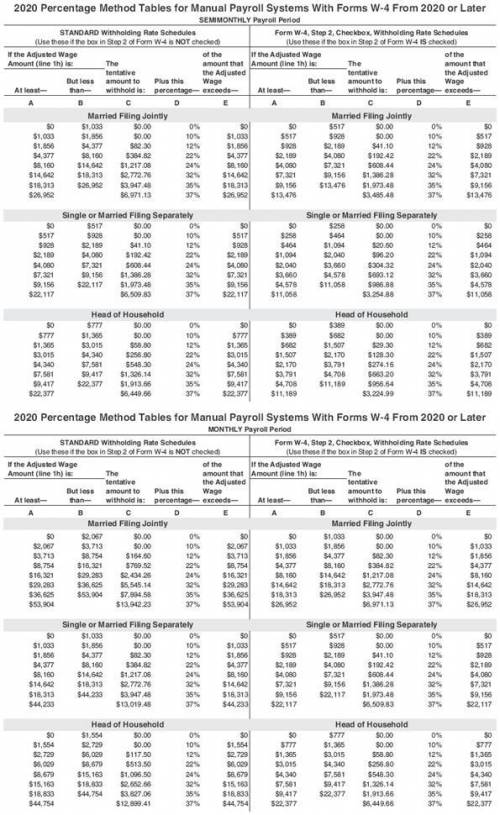

For this problem, the 2020 federal income tax tables for Manual Payroll Systems with Forms W-4 from 2019 or earlier and 2020 FICA rates have been used. See attached.

When I calculated this, I got $138.40 for the percentage method and $158 for the wage bracket method. Both are wrong and they're usually really close to the same number.

Table of Allowance Values for 2020

Weekly 83.00 Biweekly 165.00 Semimonthly 179.00 Monthly 358.00

Quarterly 1,075.00 Semiannual 2,150.00 Annual 4,300.00 Daily/Misc. 17.00

Examples of how to calculate this:

Example 4-12

To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 or Earlier, follow the steps illustrated below.

Step 1

Determine the amount of gross wages earned, marital status, number of allowances, and frequency of pay. Note: If the wage ends in a fractional dollar amount, the wage may be rounded to the nearest dollar. However, in this text, exact wages are used.

→ Wilson Goodman, single, claims two allowances and earns $915.60 semimonthly.

Step 2

Multiply the number of allowances claimed by the amount of one allowance for the appropriate payroll period, as shown in the Table of Allowance Values in Figure 4.19. → Table of Allowance Values for semimonthly payroll period shows $179.00.

Multiply $179.00 × 2 = $358.00

Step 3

Subtract the amount for the number of allowances claimed from the employee’s gross pay to find the excess of wages over allowances claimed. →

Gross pay $ 915.60

Less: Allowances 358.00

Excess wages $557.60

Step 4

Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table. → Compute tax from Tax Table C, page T-15.

($557.60 - $158.00 = $399.60 × 10% = $39.96 + $0) = $39.96

Example 4-13

To use the wage-bracket method tables for Manual Payroll Systems with Forms W-4 From 2019 or Earlier, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee’s marital status and pay period.

→ Adrienne Huff is married and claims 3 allowances.

She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee’s gross wages fall. → Locate the appropriate wage bracket (see Figure 4.20):

At least $805 but less than $820

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate number of allowances. Withhold this amount of tax. → Move across the line to the column showing 3 allowances.

The tax to withhold is $34.

Answers: 3

Another question on Business

Business, 21.06.2019 14:40

Easel manufacturing budgeted fixed overhead costs of $ 1.50 per unit at an anticipated production level of 1 comma 350 units. in july easel incurred actual fixed overhead costs of $ 4 comma 700 and actually produced 1 comma 300 units. what is easel's fixed overhead budget variance for july?

Answers: 2

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 13:10

Paid-in-capital in excess of par represents the amount of proceeds a. from the original sale of common stock b. in excess of the par value from the original sale of common stock c. at the current market value of the common stock d. at the curent book value of the common stock

Answers: 1

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

You know the right answer?

Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold...

Questions

Mathematics, 21.11.2020 18:40

Mathematics, 21.11.2020 18:40

Physics, 21.11.2020 18:40

Physics, 21.11.2020 18:40

Mathematics, 21.11.2020 18:40

History, 21.11.2020 18:40

Mathematics, 21.11.2020 18:40

English, 21.11.2020 18:40

Health, 21.11.2020 18:40

Advanced Placement (AP), 21.11.2020 18:40

History, 21.11.2020 18:40