Business, 07.10.2021 05:20 whitneyt3218

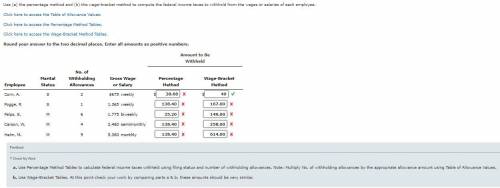

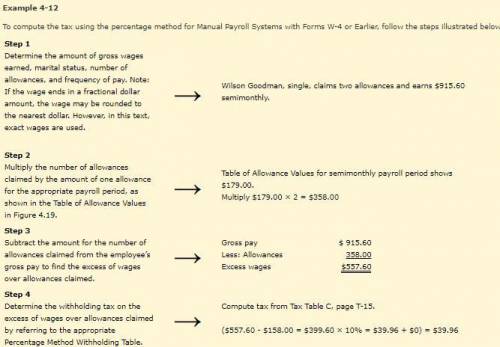

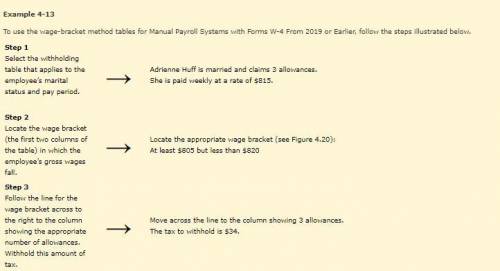

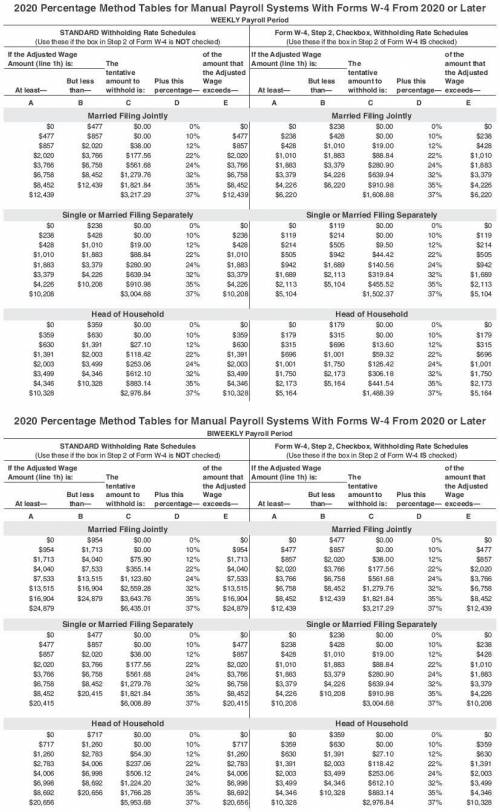

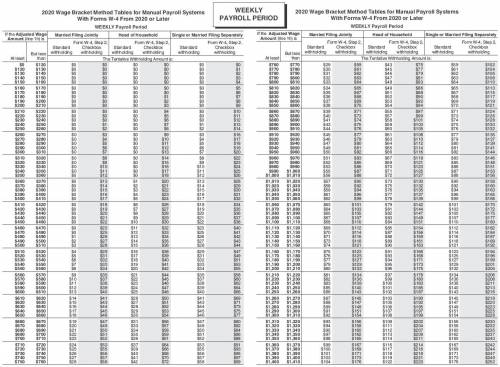

50 points to fill in the weekly part of the table of this accounting problem. See all the attachments. There are ten squares that need be be filled in on the table and I was only able to figure out how to do one. Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. I'm also posting an example of how to do it. I'm limited to five attachments so I'm hoping for a good explanation so I can finish the chart myself.

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

Select the word from the list that best fits the definition sometimes

Answers: 2

Business, 22.06.2019 09:30

An object that is clicked on and takes the presentation to a new targeted file is done through a

Answers: 2

Business, 22.06.2019 18:30

Amanufacturer has paid an engineering firm $200,000 to design a new plant, and it will cost another $2 million to build the plant. in the meantime, however, the manufacturer has learned of a foreign company that offers to build an equivalent plant for $2,100,000. what should the manufacturer do?

Answers: 1

Business, 22.06.2019 21:10

Skychefs, inc. prepares in-flight meals for a number of major airlines. one of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. during the most recent week, the company prepared 4000 of these meals using 960 direct labor hours. the company paid these direct labor workers a total of $19,200 for this work, or $20.00 per hour. according to standard cost card for this meal, it should require 0.25 direct labour-hours at a cost of $19.75 per hour.1. what is the standard labor-hours allowed (sh) to prepare 4,000 meals? 2. what is the standard labor cost allowed (sh x sr) to prepare 4,000 meals? 3. what is the labor spending variance? 4. what is the labor rate variance and the labor efficiency variance?

Answers: 3

You know the right answer?

50 points to fill in the weekly part of the table of this accounting problem. See all the attachment...

Questions

Social Studies, 03.10.2019 06:30

History, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

History, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

Health, 03.10.2019 06:30

Chemistry, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

English, 03.10.2019 06:30