Answers: 2

Another question on Business

Business, 21.06.2019 20:30

If delta airlines were to significantly change its fare structure and flight schedule to enhance its competitive position in response to aggressive price cutting by southwest airlines, this would be an example ofanswers: explicit collusion.tacit collusion.competitive dynamics.a harvest strategy.

Answers: 3

Business, 22.06.2019 02:30

Atax on the sellers of coffee will a. increase the price of coffee paid by buyers, increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. b. increase the price of coffee paid by buyers, increase the e ffective price of coffee received by sellers, and decrease the equilibrium quantity of coffee. c. increase the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. d. increa se the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

Answers: 3

Business, 22.06.2019 08:40

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 23.06.2019 16:00

Which best describes which careers would work in offices? 1.marketing information management and research, distribution and logistics, and marketing communications and promotion employees can work in offices.2.all marketing, sales, and service employees can work in offices.3.all marketing, sales, and service employees except those in management and entrepreneurship can work in offices.4.sales and service employees work in offices, but marketing employees do not

Answers: 1

You know the right answer?

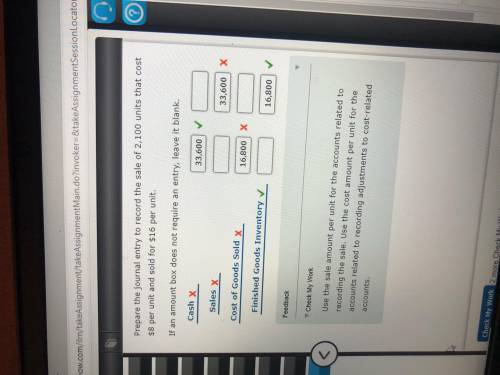

Prepare the journal entry to record the sale of 2,100 units that cost $8 per unit and sold for $16 p...

Questions

History, 31.10.2020 14:00

Arts, 31.10.2020 14:00

Social Studies, 31.10.2020 14:00

Geography, 31.10.2020 14:00

History, 31.10.2020 14:00

Business, 31.10.2020 14:00

Mathematics, 31.10.2020 14:00

Geography, 31.10.2020 14:00

Spanish, 31.10.2020 14:00

History, 31.10.2020 14:00

Computers and Technology, 31.10.2020 14:00