Business, 19.09.2021 18:40 vandonquisenberry

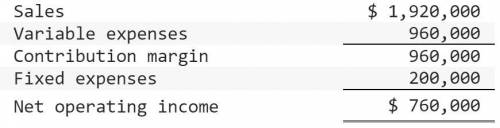

Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows:

**Attachment is given Below**

Required:

Answer each question independently based on the original data:

1. What is the product's CM ratio?

2. Use the CM ratio to determine the break-even point in dollar sales.

3. Assume this year’s unit sales and total sales increase by 49,000 units and $3,920,000, respectively. If the fixed expenses do not change, how much will net operating income increase?

4-a. What is the degree of operating leverage based on last year's sales?

4-b. Assume the president expects this year's unit sales to increase by 10%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year?

5. The sales manager is convinced that a 11% reduction in the selling price, combined with a $78,000 increase in advertising, would increase this year's unit sales by 25%.

a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented?

b. If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year?

6. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $2.30 per unit. He thinks that this move, combined with some increase in advertising, would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense and still earn the same $760,000 net operating income as last year?

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

Write two goals for yourself that will aid you in pursuing your post-secondary education or training. with this

Answers: 1

Business, 21.06.2019 21:30

On july 1, 2016, killearn company acquired 103,000 of the outstanding shares of shaun company for $21 per share. this acquisition gave killearn a 40 percent ownership of shaun and allowed killearn to significantly influence the investee's decisions. as of july 1, 2016, the investee had assets with a book value of $6 million and liabilities of $1,468,500. at the time, shaun held equipment appraised at $140,000 above book value; it was considered to have a seven-year remaining life with no salvage value. shaun also held a copyright with a five-year remaining life on its books that was undervalued by $562,500. any remaining excess cost was attributable to goodwill. depreciation and amortization are computed using the straight-line method. killearn applies the equity method for its investment in shaun. shaun's policy is to declare and pay a $1 per share cash dividend every april 1 and october 1. shaun's income, earned evenly throughout each year, was $580,000 in 2016, $606,600 in 2017, and $649,200 in 2018. in addition, killearn sold inventory costing $93,000 to shaun for $155,000 during 2017. shaun resold $97,500 of this inventory during 2017 and the remaining $57,500 during 2018.a. determine the equity income to be recognized by killearn during each of these years. 2016 2017 2018b. compute killearn’s investment in shaun company’s balance as of december 31, 2018.

Answers: 2

Business, 22.06.2019 02:20

The following information is available for juno company for the month ending june 30, 2019. * balance as per the bank statement is $ 11 comma 000. * balance as per books is $ 10 comma 400. * check #506 for $ 1 comma 200 and check #510 for $ 900 were not shown on the june 30, bank statement. * a deposit in transit of $ 3 comma 346 had not been received by the bank when the bank statement was generated. * a bank debit memo indicated an nsf check for $ 70 written by jane smith to juno company on june 13. * a bank credit memo indicated a note collected by the bank of $ 1 comma 900 and interest revenue of $ 51 on june 20. * the bank statement indicated service charges of $ 35. what is the adjusted book balance?

Answers: 3

Business, 22.06.2019 11:00

Down under products, ltd., of australia has budgeted sales of its popular boomerang for the next four months as follows: unit salesapril 74,000may 85,000june 114,000july 92,000the company is now in the process of preparing a production budget for the second quarter. past experience has shown that end-of-month inventory levels must equal 10% of the following month’s unit sales. the inventory at the end of march was 7,400 units.required: prepare a production budget by month and in total, for the second quarter.

Answers: 3

You know the right answer?

Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per un...

Questions

Physics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Mathematics, 29.03.2021 04:40

Chemistry, 29.03.2021 04:40