Business, 09.09.2021 02:40 nikejose11

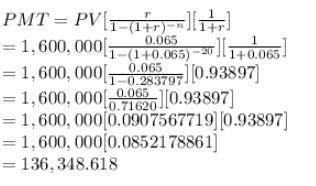

Prof. Business will have $1,600,000 saved up by retirement at age 65. The retired professor expects to live 20 more years after retiring. How large of an annual annuity withdrawal can prof. Finance make at the beginning of each year under this scenario from an account paying 6. 5% compounded annually? round your answer to the nearest dollar.

Answers: 2

Another question on Business

Business, 22.06.2019 22:50

What is one of the advantages of getting a government-sponsored mortgage instead of a conventional mortgage

Answers: 1

Business, 23.06.2019 06:00

Before setting your prices, it's wise to a. subtract your profit margin from your costs. b. research industry standards. c. memorize the formula for cost plus. d. ignore your competitors' prices.

Answers: 1

Business, 23.06.2019 11:00

What are the factors that affects on the process of planning

Answers: 3

Business, 23.06.2019 11:00

Comparative financial statements for weller corporation, a merchandising company, for the year ending december 31 appear below. the company did not issue any new common stock during the year. a total of 800,000 shares of common stock were outstanding. the interest rate on the bonds, which were sold at their face value, was 12%. the income tax rate was 40% and the dividend per share of common stock was $0.40 this year. the market value of the company's common stock at the end of the year was $18. all of the company's sales are on account. time interest earned ratio

Answers: 3

You know the right answer?

Prof. Business will have $1,600,000 saved up by retirement at age 65. The retired professor expects...

Questions

Mathematics, 09.12.2020 18:10

Biology, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

English, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

Social Studies, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10

Mathematics, 09.12.2020 18:10