Business, 28.08.2021 01:10 carlos113101

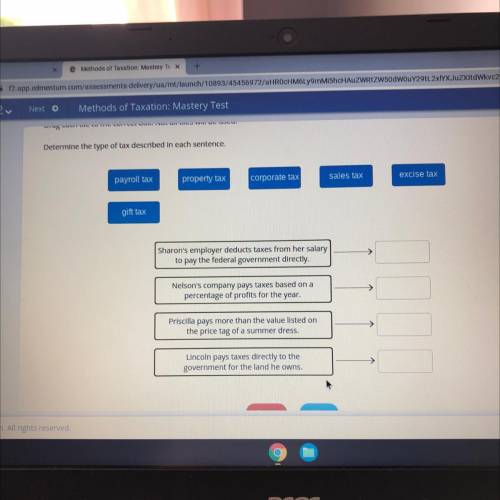

Drag each tile to the correct box. Not all tiles will be used.

Determine the type of tax described in each sentence.

payroll tax

excise tax

property tax corporate tax

sales tax

gift tax

Sharon's employer deducts taxes from her salary

to pay the federal government directly.

>

Nelson's company pays taxes based on a

percentage of profits for the year.

>

Priscilla pays more than the value listed on

the price tag of a summer dress.

Lincoln pays taxes directly to the

government for the land he owns.

Answers: 2

Another question on Business

Business, 22.06.2019 19:10

Robin hood has hired you as his new strategic consultant to him successfully transform his social change enterprise. robin has told you that he counting on your strategic management knowledge to him and his merrymen achieve their goals. discuss in detail what you think should be robin’s two primary strategic goals and continue by also explaining your analytical reasons that support your recommendations.

Answers: 3

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

Business, 22.06.2019 20:00

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

You know the right answer?

Drag each tile to the correct box. Not all tiles will be used.

Determine the type of tax described...

Questions

Chemistry, 01.04.2021 20:20

English, 01.04.2021 20:20

Mathematics, 01.04.2021 20:20

Chemistry, 01.04.2021 20:20

Chemistry, 01.04.2021 20:20

Spanish, 01.04.2021 20:20

Biology, 01.04.2021 20:20

Mathematics, 01.04.2021 20:20

Chemistry, 01.04.2021 20:20

Mathematics, 01.04.2021 20:20

Mathematics, 01.04.2021 20:20

Mathematics, 01.04.2021 20:20