Business, 30.07.2021 08:00 neonaandrews10

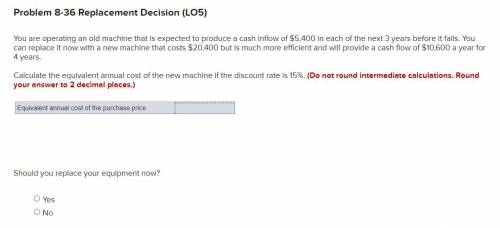

You are operating an old machine that is expected to produce a cash inflow of $5,400 in each of the next 3 years before it fails. You can replace it now with a new machine that costs $20,400 but is much more efficient and will provide a cash flow of $10,600 a year for 4 years.

Calculate the equivalent annual cost of the new machine if the discount rate is 15%. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Should you replace your equipment now?

multiple choice

Yes

No

Answers: 3

Another question on Business

Business, 21.06.2019 21:20

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 22.06.2019 09:30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 19:00

Lucy is catering an important luncheon and wants to make sure her bisque has the perfect consistency. for her bisque to turn out right, it should have the consistency of a. cold heavy cream. b. warm milk. c. foie gras. d. thick oatmeal.

Answers: 3

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

You know the right answer?

You are operating an old machine that is expected to produce a cash inflow of $5,400 in each of the...

Questions

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Social Studies, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Computers and Technology, 05.02.2021 16:40

Biology, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

English, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40

Mathematics, 05.02.2021 16:40