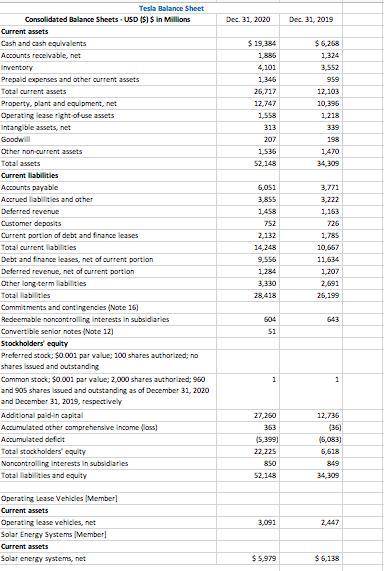

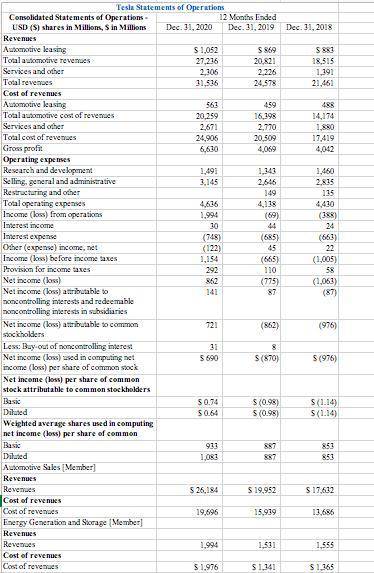

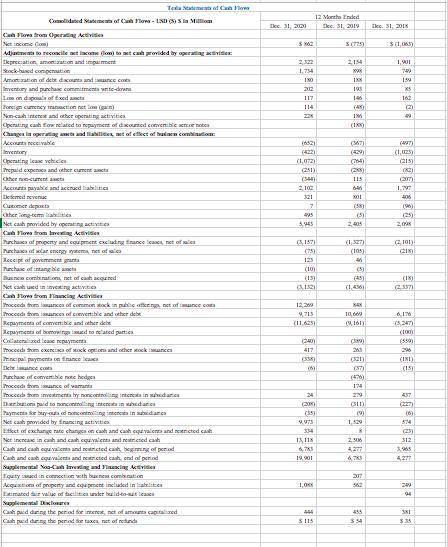

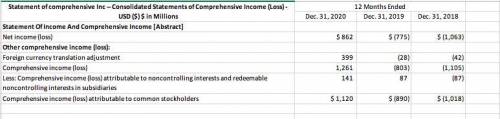

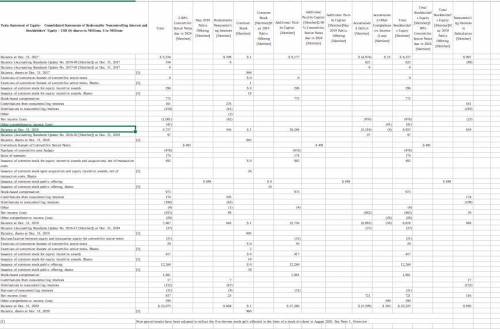

Compare and evaluate Tesla financial statements based on the below points.

Size

o total...

Business, 07.07.2021 08:10 aiken11192006

Compare and evaluate Tesla financial statements based on the below points.

Size

o total assets and total revenue

o market cap

Growth

o asset growth and revenue growth

o market to book ratio

o price to earnings ratio (P/E ratio)

Use following ratios or financial statemen item to compare and analyze business performance.

Profitability

o gross profit percentage (LO 5.6)

o return on assets (LO 1.6)

o return on common stockholders’ equity, earnings per share, and the price/earnings ratio (LO 13.7)

Solvency

o debt ratio (LO 2.5)

o debt to equity (12.6)

o free cash flows

Liquidity

o current ratio (LO 4.6)

o acid-test ratio (LO 8.5)

Operating Efficiency

o inventory turnover, days’ sales in inventory (LO 6.6)

o accounts receivable turnover ratio, and days’ sales in receivables (LO 8.5)

o asset turnover ratio (LO 9.6)

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

What is the difference between a public and a private corporation?

Answers: 1

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 08:40

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u.s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 19:30

Which of the following constitute the types of unemployment occurring at the natural rate of unemployment? a. frictional and cyclical unemployment.b. structural and frictional unemployment.c. cyclical and structural unemployment.d. frictional, structural, and cyclical unemployment.

Answers: 2

You know the right answer?

Questions

History, 18.10.2019 01:30

Mathematics, 18.10.2019 01:30

Geography, 18.10.2019 01:30

Health, 18.10.2019 01:30

History, 18.10.2019 01:30

Biology, 18.10.2019 01:30

History, 18.10.2019 01:30

History, 18.10.2019 01:30

History, 18.10.2019 01:30

Physics, 18.10.2019 01:30