Business, 01.07.2021 15:20 torresq6647

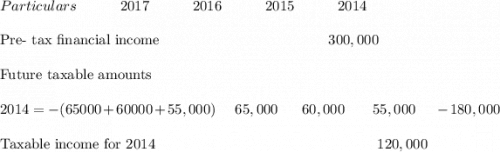

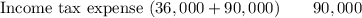

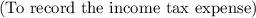

South Carolina Corporation has one temporary difference at the end of 2014 that will reverse and cause taxable amounts of $55,000 in 2015, $60,000 in 2016, and $65,000 in 2017. South Carolina's pretax financial income for 2014 is $300,000, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2014.Instructions(a) Compute taxable income and income taxes payable for 2014.(b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2014.(c) Prepare the income tax expense section of the income statement for 2014, beginning with the line ?Income before income taxes.?

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Why is it vital to maintain a designer worksheet? a. it separates the designs chosen for the season from those rejected by the company. b. it keeps a record of all designs created by the designer for a season. c. it charts out the development of an entire line through the season and beyond. d. it tracks the development of a design along with costing and production details. done

Answers: 1

Business, 22.06.2019 08:20

Suppose that jim plans to borrow money for an education at texas a& m university. jim will need to borrow $25,000 at the end of each year for the next five years (total=$125,000). jim wishes his parents could pay for his education but they can’t. at least, he qualifies for government loans with a reduced interest rate while he is in school. he has a special arrangement with aggiebank to lend him the money at a subsidized rate of 1% over five years without having to make a payment until the end of the fifth year. however, at the end of the fifth year, jim agrees to pay off the loan by borrowing from longhorn bank. longhorn bank will lend him the money he needs at an annual interest rate of 6%. jim agrees to pay back the longhorn bank with 20 annual payments and the payments will be uniform (equal annual payments including principal and interest). (i) calculate how much money jim has to borrow at the end of 5 years to pay off the loan with aggiebank. a. $121,336 b. $127,525 c. $125,000 d. $102,020 e. none of the above

Answers: 2

Business, 22.06.2019 15:20

Kelso electric is debating between a leveraged and an unleveraged capital structure. the all equity capital structure would consist of 40,000 shares of stock. the debt and equity option would consist of 25,000 shares of stock plus $280,000 of debt with an interest rate of 7 percent. what is the break-even level of earnings before interest and taxes between these two options?

Answers: 2

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

You know the right answer?

South Carolina Corporation has one temporary difference at the end of 2014 that will reverse and cau...

Questions

English, 15.12.2020 09:10

Physics, 15.12.2020 09:10

History, 15.12.2020 09:10

Mathematics, 15.12.2020 09:10

Mathematics, 15.12.2020 09:10

Chemistry, 15.12.2020 09:10

Mathematics, 15.12.2020 09:10

Biology, 15.12.2020 09:10

Chemistry, 15.12.2020 09:10

Spanish, 15.12.2020 09:10

World Languages, 15.12.2020 09:10

English, 15.12.2020 09:10

Spanish, 15.12.2020 09:10