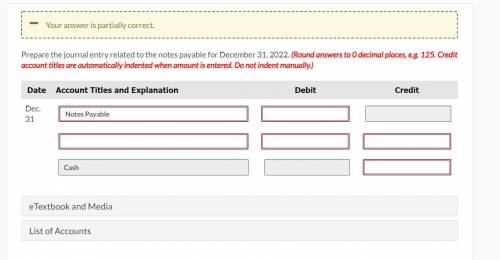

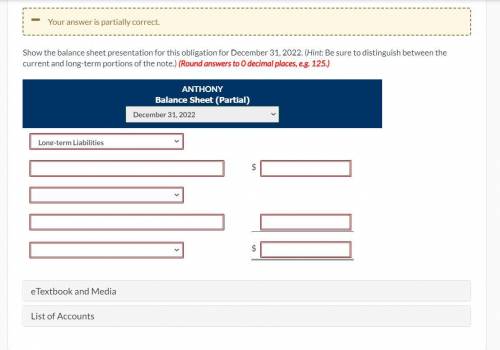

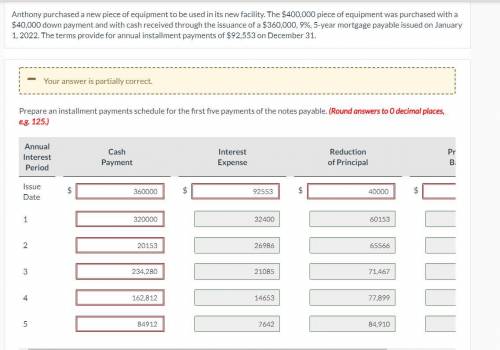

Anthony purchased a new piece of equipment to be used in its new facility. The $400,000 piece of equipment was purchased with a $40,000 down payment and with cash received through the issuance of a $360,000, 9%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $92,553 on December 31.

1.) Prepare an installment payments schedule for the first five payments of the notes payable. (Round answers to 0 decimal places, e. g. 125.)

2.) Prepare the journal entry related to the notes payable for December 31, 2022. (Round answers to 0 decimal places, e. g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

3.) Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.) (Round answers to 0 decimal places, e. g. 125.)

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

The winston company estimates that the factory overhead for the following year will be $1,250,000. the company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 50,000 hours. the total machine hours for the year were 54,300. the actual factory overhead for the year were $1,375,000. determine the over- or underapplied amount for the year.

Answers: 1

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 22.06.2019 19:30

Fly-by products, inc. operates primarily in the united states and has several segments. for the following segment, determine whether it is a cost center, profit center, or investment center: international operations- acts as an independent segment responsible for all facets of the business outside of the united states. select one: a. cost center b. profit center c. investment center

Answers: 2

Business, 22.06.2019 23:00

You cannot make copies of media, even as a personal backup, without violating copyright. true

Answers: 3

You know the right answer?

Anthony purchased a new piece of equipment to be used in its new facility. The $400,000 piece of equ...

Questions

Physics, 23.08.2019 04:00

Biology, 23.08.2019 04:00

Mathematics, 23.08.2019 04:00

Mathematics, 23.08.2019 04:00

Business, 23.08.2019 04:00

Biology, 23.08.2019 04:00

Social Studies, 23.08.2019 04:00

Mathematics, 23.08.2019 04:00

History, 23.08.2019 04:00

Social Studies, 23.08.2019 04:00

Mathematics, 23.08.2019 04:00

English, 23.08.2019 04:00