Business, 25.06.2021 04:40 santana647

A. A stock's returns have the following distribution:

Demand for the

Company's Products Probability of This

Demand Occurring Rate of Return If

This Demand Occurs

Weak 0.1 (22%)

Below average 0.2 (12)

Average 0.3 17

Above average 0.2 33

Strong 0.2 56

1.0

Calculate the stock's expected return. Round your answer to two decimal places.

%

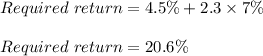

Calculate the stock's standard deviation. Do not round intermediate calculations. Round your answer to two decimal places.

%

Calculate the stock's coefficient of variation. Round your answer to two decimal places.

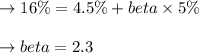

B. A stock has a required return of 16%; the risk-free rate is 4.5%; and the market risk premium is 5%.

What is the stock's beta? Round your answer to two decimal places.

If the market risk premium increased to 7%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. :

I. If the stock's beta is greater than 1.0, then the change in required rate of return will be greater than the change in the market risk premium.

II. If the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market risk premium.

III. If the stock's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market risk premium.

IV. If the stock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk premium.

V. If the stock's beta is equal to 1.0, then the change in required rate of return will be less than the change in the market risk premium.

New stock's required rate of return will be ?%. Round your answer to two decimal places.

Answers: 1

Another question on Business

Business, 22.06.2019 09:30

Darlene has a balance of 3980 on a credit card with an apr of 22.8% paying off her balance and which of these lengths of time will result in her paying the least amount of interest?

Answers: 2

Business, 22.06.2019 11:40

You are a manager at asda. you have been given the demand data for the past 10 weeks for swim rings for children. you decide to run multiple types of forecasting methods on the data to see which gives you the best forecast. if you were to use exponential smoothing with alpha =.8, what would be your forecast for week 22? (the forecast for week 21 was 1277.) week demand 12 1317 13 1307 14 1261 15 1258 16 1267 17 1256 18 1268 19 1277 20 1277 21 1297

Answers: 3

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 22.06.2019 21:50

The third program provides families with $50 in food stamps each week, redeemable for both perishable and nonperishable food. the fourth policy instead provides a family with a box of nonperishable foods each week, worth $50. use two graphs to illustrate that a family may be indifferent between the two programs, but will never prefer the $50 box of nonperishable foods over the $50 in food stamps. state your answer and use a consumer choice model for perishable food and nonperishable food to graphically justify your choice.

Answers: 1

You know the right answer?

A. A stock's returns have the following distribution:

Demand for the

Company's Products Proba...

Company's Products Proba...

Questions

Mathematics, 04.11.2020 01:00

Mathematics, 04.11.2020 01:00

Mathematics, 04.11.2020 01:00

Arts, 04.11.2020 01:00

Arts, 04.11.2020 01:00

Chemistry, 04.11.2020 01:00

Mathematics, 04.11.2020 01:00

Mathematics, 04.11.2020 01:00

Biology, 04.11.2020 01:00

Mathematics, 04.11.2020 01:00

Biology, 04.11.2020 01:00

![Std \ dev = [0.1 \times (0.183-(-0.22))^2 + 0.2 \times (0.183-(-0.12))^2 + 0.3\times(0.183-0.17)^2 + 0.2\times (0.183-0.33)^2 + 0.2\times (0.183-0.56)^2]^{(\frac{1}{2})}\\\\](/tpl/images/1383/8111/3b532.png)