Business, 24.06.2021 23:00 sandyyknguyen2155

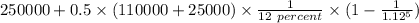

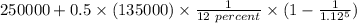

The Z−90 project being considered by Steppingstone Incorporated (SI) has an up-front cost of $250,000. The project's subsequent cash flows are critically dependent on whether another of its products, Z−45, becomes an industry standard. There is a 50% chance that the Z−45 will become the industry standard, in which case the Z−90's expected cash flows will be $110,000 at the end of each of the next 5 years. There is a 50% chance that the Z−45 will not become the industry standard, in which case the Z−90's expected cash flows will be $25,000 at the end of each of the next 5 years. Assume that the cost of capital is 12%. Refer to data for Steppingstone Incorporated. Based on the above information, what is the Z−90's expected net present value? Group of answer choices−$6,678 −$3,251 $15,303 $20,004 $45,965

Answers: 3

Another question on Business

Business, 22.06.2019 06:00

Use this image to answer the following question. when the economy is operating at point b, the us congress is most likely to follow

Answers: 3

Business, 22.06.2019 12:30

Sales at a fast-food restaurant average $6,000 per day. the restaurant decided to introduce an advertising campaign to increase daily sales. to determine the effectiveness of the advertising campaign, a sample of 49 days of sales were taken. they found that the average daily sales were $6,300 per day. from past history, the restaurant knew that its population standard deviation is about $1,000. if the level of significance is 0.01, have sales increased as a result of the advertising campaign? multiple choicea)fail to reject the null hypothesis.b)reject the null hypothesis and conclude the mean is higher than $6,000 per day.c)reject the null hypothesis and conclude the mean is lower than $6,000 per day.d)reject the null hypothesis and conclude that the mean is equal to $6,000 per day.expert answer

Answers: 3

Business, 22.06.2019 18:50

Plastic and steel are substitutes in the production of body panels for certain automobiles. if the price of plastic increases, with other things remaining the same, we would expect: a) the demand curve for plastic to shift to the left. b) the price of steel to fall. c) the demand curve for steel to shift to the left d) nothing to happen to steel because it is only a substitute for plastic. e) the demand curve for steel to shift to the right

Answers: 3

You know the right answer?

The Z−90 project being considered by Steppingstone Incorporated (SI) has an up-front cost of $250,00...

Questions

Mathematics, 19.11.2019 22:31

Mathematics, 19.11.2019 22:31

Mathematics, 19.11.2019 22:31

Mathematics, 19.11.2019 22:31

World Languages, 19.11.2019 22:31

Biology, 19.11.2019 22:31

History, 19.11.2019 22:31

($)

($)