Business, 24.06.2021 15:20 gonzalesalexiaouv1bg

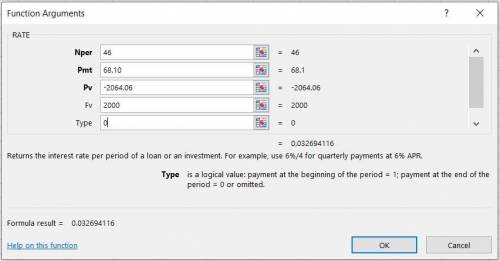

There is a bond that has a quoted price of 103.203 and a par value of $2,000. The coupon rate is 6.81 percent and the bond matures in 23 years. If the bond makes semiannual coupon payments, what is the effective annual interest rate

Answers: 1

Another question on Business

Business, 21.06.2019 16:00

When earning simple interest on money you invest, which statement is true? a. as time goes on and your bank account grows, you earn more interest. b. as time goes on and your bank account grows, you earn less interest. c. as time goes on and your bank account grows, you earn the same amount of interest. d. as time goes on and your bank account grows, you stop earning interest.

Answers: 2

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 23.06.2019 23:00

Using a ucf graduate's current year tax data below, what is the adjusted gross income: wages = $55,000 ordinary dividends = $1,000 interest on municipal bonds = $2,000 traditional ira contribution = $3,000 short term capital gain = $ 9,000 alimony paid = $20,000 $42,000 $80,000 $46,000 $88,000 $40,000

Answers: 2

You know the right answer?

There is a bond that has a quoted price of 103.203 and a par value of $2,000. The coupon rate is 6.8...

Questions

English, 30.03.2021 22:40

Geography, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40

Biology, 30.03.2021 22:40

History, 30.03.2021 22:40

History, 30.03.2021 22:40

Mathematics, 30.03.2021 22:40