Business, 22.06.2021 01:00 supasavb99

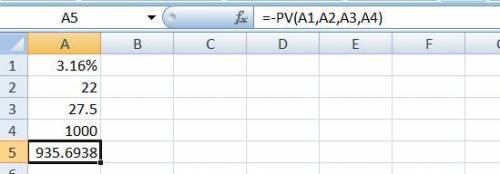

Wine and Roses, Inc. offers a 5.5 percent coupon bond with semiannual payments and a yield to maturity of 6.32 percent. The bonds mature in 11 years. What is the market price of a $1,000 face value bond?a. $1,008.79b. $1,431.32c. $1,504.37d. $935.69e. $1,367.02

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

Business, 23.06.2019 02:30

Perform a goal seek analysis to find a packing weight that will bring the shipping weight of the retro fit clothing set down to 39.75 lbs. use cell i9 as the cell to set, 39.75 as the target value, and cell f5 as the changing cell. keep the values generated by the goal seek analysis as the value for cells f5, i9, and i10.

Answers: 2

You know the right answer?

Wine and Roses, Inc. offers a 5.5 percent coupon bond with semiannual payments and a yield to maturi...

Questions

Physics, 09.01.2020 06:31

History, 09.01.2020 06:31

Social Studies, 09.01.2020 06:31

Mathematics, 09.01.2020 06:31

History, 09.01.2020 06:31

Mathematics, 09.01.2020 06:31

Biology, 09.01.2020 06:31

Biology, 09.01.2020 06:31

Mathematics, 09.01.2020 06:31

Mathematics, 09.01.2020 06:31

Mathematics, 09.01.2020 06:31