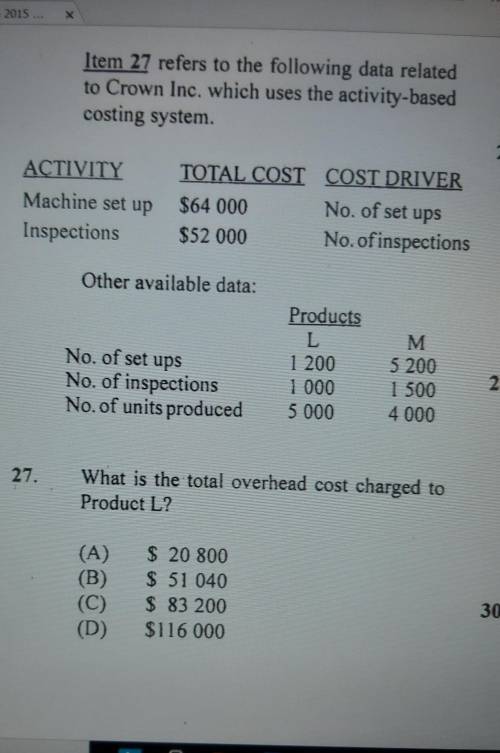

Please help, no matter what I try I only got A but that's not the total overhead : (

...

Answers: 1

Another question on Business

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 21.06.2019 23:30

Using the exxon data as an example what would be the market capitalization of penny's pickles if each share is selling for $175.35?

Answers: 3

Business, 22.06.2019 02:30

The cost of capital: introduction the cost of capital: introduction companies issue bonds, preferred stock, and common equity to aise capital to invest in capital budgeting projects. capital is』necessary factor of production and like any other factor, it has a cost. this cost is equal to the select the applicable security. the rates of return that investors require on bonds, preferred stocks, and common equity represent the costs of those securities to the firm. companies estimate the required returns on their securities, calculate a weighted average of the costs of their different types of capital, and use this average cost for capital budgeting purposes. required return on rate: when calculating om operations when the firm's primary financial objective is to select shareholder value. to do this, companies invest in projects that earnselect their cost of capital. so, the cost of capital is often referred to as the -select -select and accruals, which a se spontaneously we hted average cost of capital wa c our concern is with capital that must be provided by select- 쑤 interest-bearing debt preferred stock and common equity. capital budgeting projects are undertaken, are not included as part of total invested capital because they do not come directly from investors. which of the following would be included in the caculation of total invested capital? choose the response that is most correct a. notes payable b. taxes payable c retained earnings d. responses a and c would be included in the calculation of total invested capital. e. none of the above would be included in the cakulation of total invested capital.

Answers: 2

Business, 22.06.2019 15:30

University hero is considering expanding operations beyond its healthy sandwiches. jim axelrod, vice president of marketing, would like to add a line of smoothies with a similar health emphasis. each smoothie would include two free health supplements such as vitamins, antioxidants, and protein. jim believes smoothie sales should fill the slow mid-afternoon period. adding the line of smoothies would require purchasing additional freezer space, machinery, and equipment. jim provides the following projections of net sales, net income, and average total assets in support of his proposal. sandwichesonly sandwiches and smoothies net sales $ 750,000 $ 1,350,000 net income 120,000 210,000 average total assets 350,000 750,000 return on assetschoose numerator ÷ choose denominator = return on assets÷ = return on assets÷ = profit margin÷ = profit margin÷ = asset turnover÷ = asset turnover÷ = times

Answers: 2

You know the right answer?

Questions

Mathematics, 17.09.2020 07:01

English, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Physics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

English, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

English, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

English, 17.09.2020 07:01

History, 17.09.2020 07:01

Mathematics, 17.09.2020 07:01

English, 17.09.2020 07:01