Business, 20.06.2021 16:20 georgesk2030

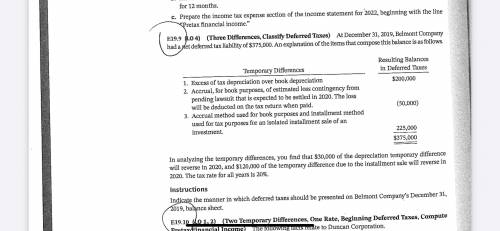

Pls help me with this : At December 31, 2019, Belmont Company had a fet deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows.

Resulting Balances

in Deferred Taxes

$200,000

Temporary Differences

1. Excess of tax depreciation over book depreciation

2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2020. The loss will be deducted on the tax return when paid.

3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment.

(50,000)

225,000

$375,000

In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2020, and $120,000 of the temporary difference due to the installment sale will reverse in 2020. tax rate for all years is 20%.

Instructions

Indicate the manner in which deferred taxes should be presented on Belmont Company's December 31, 2019, balance sheet.

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

Alocal barnes and noble bookstore ordered 80 marketing books but received 60 books. what percent of the order was missing?

Answers: 1

Business, 22.06.2019 12:40

When cell phones were first entering the market, they were relatively large and reception was undependable. all cell phones were essentially the same. but as the technology developed, many competitors entered, introducing features unique to their phones. today, cell phones are only a small fraction of the size and weight of their predecessors. consumers can buy cell phones with color screens, cameras, internet access, daily planners, or voice activation (and any combination of these features). the history of the cell phone demonstrates what marketing trend?

Answers: 3

Business, 22.06.2019 19:30

Alaska king crab fishing in the 1960s and '70s was a dangerous but rich fishery. boats from as far away as california and japan braved the treacherous gulf of alaska crossing to reach the abundant king crab beds in cook inlet and bristol bay. suddenly, in the early 1980s, the fishery crashed due to over fishing. all crabbing in those areas ended. to this day, there is no crabbing in bristol bay or cook inlet. a. how would an economist explain the decline of the alaska king crab fishery

Answers: 3

You know the right answer?

Pls help me with this : At December 31, 2019, Belmont Company had a fet deferred tax liability of $3...

Questions

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

English, 10.07.2019 23:00

History, 10.07.2019 23:00

History, 10.07.2019 23:00

History, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Mathematics, 10.07.2019 23:00

Chemistry, 10.07.2019 23:00

Social Studies, 10.07.2019 23:00

Biology, 10.07.2019 23:00