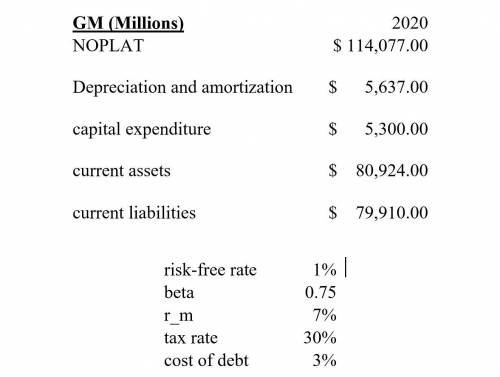

The table above summarizes financial information of General Motors for fiscal year 2020. Its total assets is $235,194 million, and its total liabilities is $185,517 million. Suppose General Motors decides to start another electronic car production line. To implement this decision, GM will increase capital expenditure by 10% each year for the next three years. To finance the increase in capital expenditure, GM will draw its credit lines which increases its current liabilities by 12% each year for the next three years. This new production lines will also require GM to expand its current assets by 15% each year for the next three years. Moreover, GM expects the depreciation and amortization increase by 5% for the next three years. The new production line will increase the net operating profit after tax by 2% for the first three years, and free cash flow after the 3rd grows at 1% permanently thereafter. GM has 1,433 million shares outstanding. What is the fundamental value of GM’s common stock?

Answers: 3

Another question on Business

Business, 22.06.2019 19:00

The east asiatic company (eac), a danish company with subsidiaries throughout asia, has been funding its bangkok subsidiary primarily with u.s. dollar debt because of the cost and availability of dollar capital as opposed to thai baht-denominated (b) debt. the treasurer of eac-thailand is considering a 1-year bank loan for $247,000.the current spot rate is b32.03 /$, and the dollar-based interest is 6.78% for the 1-year period. 1-year loans are 12.04% in baht.a. assuming expected inflation rates of 4.3 % and 1.24% in thailand and the united states, respectively, for the coming year, according to purchase power parity, what would the effective cost of funds be in thai baht terms? b. if eac's foreign exchange advisers believe strongly that the thai government wants to push the value of the baht down against the dollar by5% over the coming year (to promote its export competitiveness in dollar markets), what might the effective cost of funds end up being in baht terms? c. if eac could borrow thai baht at 13% per annum, would this be cheaper than either part (a) or part (b) above?

Answers: 2

Business, 23.06.2019 16:00

Benning manufacturing company is negotiating with a customer for the lease of a large machine manufactured by benning. the machine has a cash price of $980,000. benning wants to be reimbursed for financing the machine at a 9% annual interest rate. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) required: 1. determine the required lease payment if the lease agreement calls for 10 equal annual payments beginning immediately. 2. determine the required lease payment if the first of 10 annual payments will be made one year from the date of the agreement. 3. determine the required lease payment if the first of 10 annual payments will be made immediately and benning will be able to sell the machine to another customer for $68,000 at the end of the 10-year lease.

Answers: 1

Business, 23.06.2019 22:00

According to federal regulations, an irb must have at least two community members to fulfill membership requirements; one member whose expertise is not in a scientific area and one member who is not affiliated with the institution.

Answers: 1

Business, 24.06.2019 00:30

Janice is a baby boomer, born in 1959. between the ages of 18 and 50, she held only five jobs. according to a study published by the bureau of labor statistics in 2015, janice's experience is below the job average for people born from 1957 to 1964, who held an average of jobs between the ages of 18 and 48.

Answers: 1

You know the right answer?

The table above summarizes financial information of General Motors for fiscal year 2020. Its total a...

Questions

Geography, 22.09.2019 17:30

Social Studies, 22.09.2019 17:30

Mathematics, 22.09.2019 17:30

History, 22.09.2019 17:30

Chemistry, 22.09.2019 17:30

Mathematics, 22.09.2019 17:30

Biology, 22.09.2019 17:30

Biology, 22.09.2019 17:30