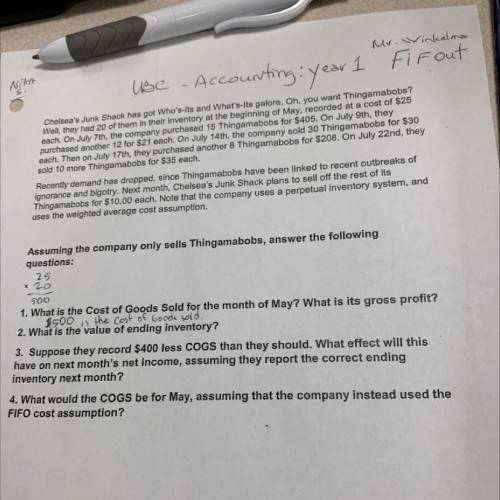

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they had 20 of them in their inventory at the beginning of May, recorded at a cost of $25

each. On July 7th, the company purchased 15 Thingamabobs for $405. On July 9th, they

purchased another 12 for $21 each. On July 14th, the company sold 30 Thingamabobs for $30

each. Then on July 17th, they purchased another 8 Thingamabobs for $208. On July 22nd, they

sold 10 more Thingamabobs for $35 each.

Recently demand has dropped, since Thingamabobs have been linked to recent outbreaks of

ignorance and bigotry. Next month, Chelsea's Junk Shack plans to sell off the rest of its

Thingamabobs for $10.00 each. Note that the company uses a perpetual inventory system, and

uses the weighted average cost assumption.

Assuming the company only sells Thingamabobs, answer the following

questions:

25

x 20

900

1. What is the Cost of Goods Sold for the month of May? What is its gross profit?

asoom the conoscono

2. What is the value of ending inventory?

3. Suppose they record $400 less COGS than they should. What effect will this

have on next month's net income, assuming they report the correct ending

inventory next month?

4. What would the COGS be for May, assuming that the company instead used the

FIFO cost assumption?

Answers: 3

Another question on Business

Business, 20.06.2019 18:04

Https: //.cthe government of semput (e.g. a fictitious country) plans the goods and services that semput produces, the quantity of goods produced, and the prices at which goods are sold. semput is a economy. market mixed command theocratic pluralm/94215585/international-business-ch-2-flash-cards/

Answers: 1

Business, 21.06.2019 19:40

Your mother's well-diversified portfolio has an expected return of 12.0% and a beta of 1.20. she is in the process of buying 100 shares of safety corp. at $10 a share and adding it to her portfolio. safety has an expected return of 15.0% and a beta of 2.00. the total value of your current portfolio is $9,000. what will the expected return and beta on the portfolio be after the purchase of the safety stock?

Answers: 3

Business, 22.06.2019 03:30

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 17:40

Solomon chemical company makes three products, b7, k6, and x9, which are joint products from the same materials. in a standard batch of 320,000 pounds of raw materials, the company generates 70,000 pounds of b7, 150,000 pounds of k6, and 100,000 pounds of x9. a standard batch costs $3,840,000 to produce. the sales prices per pound are $10, $14, and $20 for b7, k6, and x9, respectively. (a) allocate the joint product cost among the three final products using weight as the allocation base. (b) allocate the joint product cost among the three final products using market value as the allocation base. (c) allocate the joint product cost among the three final products using weight as the allocation base.

Answers: 3

You know the right answer?

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they...

Questions

History, 14.12.2020 22:50

Mathematics, 14.12.2020 22:50

English, 14.12.2020 22:50

Mathematics, 14.12.2020 22:50

Arts, 14.12.2020 22:50

Biology, 14.12.2020 22:50

Mathematics, 14.12.2020 22:50

Mathematics, 14.12.2020 22:50