Business, 04.06.2021 20:10 meleaallison

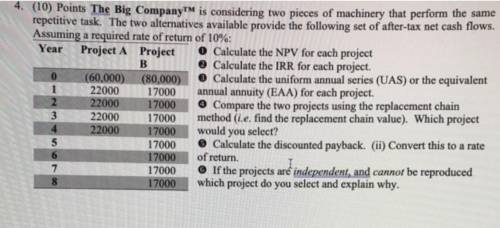

(25) Points The Big Company™ is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. Assuming a required rate of return of 10%: Calculate the NPV for each project Calculate the IRR for each project. Calculate the uniform annual series (UAS) or the equivalent annual annuity (EAA) for each project. Compare the two projects using the replacement chain method (i. e. find the replacement chain value). Which project would you select? Calculate the discounted payback. (ii) Convert this to a rate of return. If the projects are mutually exclusive, and can be reproduced which project do you select? Explain.

Answers: 1

Another question on Business

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 21:50

Which of the following best describes the economic effect that results from the government having a budget surplus? a. consumers save more and spend less, enabling long-term financial planning. b. overall demand decreases, reducing the incentive for producers to increase production. c. banks have more deposits, enabling them to make more loans to investors. d. government spending increases, increasing competition for goods and services and driving prices up.

Answers: 3

Business, 22.06.2019 23:00

What is the purpose of the us international trade association?

Answers: 2

Business, 23.06.2019 00:40

Assume the total cost of a college education will be $250,000 when your child enters college in 17 years. you presently have $69,000 to invest. what annual rate of interest must you earn on your investment to cover the cost of your child’s college education? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers: 2

You know the right answer?

(25) Points The Big Company™ is considering two pieces of machinery that perform the same repetitive...

Questions

History, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

Health, 23.03.2021 17:10

Physics, 23.03.2021 17:10

History, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10

English, 23.03.2021 17:10

Mathematics, 23.03.2021 17:10