Business, 03.06.2021 01:00 GreenHerbz206

More Hits Company manufactures aluminum baseball bats that it sells to university athletic departments. It has developed the following per unit standard costs for 2019 for each baseball bat:

Direct Materials Direct Labor Manufacturing Overhead

Standard Quantity 2 Pounds (Aluminum) 1/2 hour 1/2 hour

Standard Price $4.00 $10.00 $6.00

Unit Standard Cost $8.00 $5.00 $3.00

In 2019, the company planned to produce 120,000 baseball bats at a level of 60,000 hours of direct labor. Actual results for 2019 are presented below:

1. Direct materials purchases were 246,000 pounds of aluminum which cost $1,020,900.

2. Direct materials used were 220,000 pounds of aluminum.

3. Direct labor costs were $575,260 for 58,700 direct labor hours actually worked.

4. Total manufacturing overhead was $352,000.

5. Actual production was 114,000 baseball bats.

Compute the following variances and identify whether the variance is favorable or unfavorable:

1. Direct Materials Price

2. Direct Materials Quantity

3. Direct Labor Price

4. Direct Labor Quantity

5. Total Overhead Variances

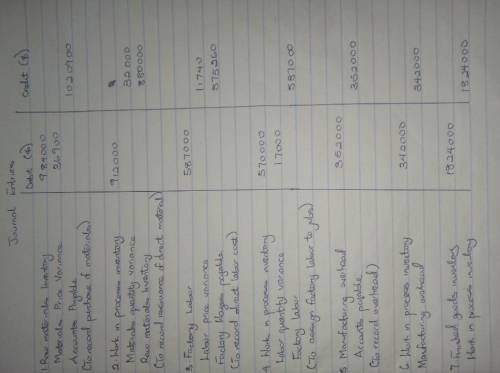

Prepare the journal entries to record the transactions and events in 2019.

Answers: 1

Another question on Business

Business, 22.06.2019 01:50

You are an employee of an u.s. firm that produces personal computers in thailand and then exports them to the united states and other countries for sale. the personal computers were originally produced in thailand to take advantage of relatively low labor costs and a skilled workforce. other possible locations considered at that time were malaysia and hong kong. the u.s. government decides to impose punitive 100% ad valorem tariffs on imports of computers from thailand to punish the country for administrative trade barriers that restrict u.s. exports to thailand. how do you think your firm should respond? what does this tell you about the use of targeted trade barriers?

Answers: 3

Business, 22.06.2019 04:50

Allie and sarah decided that they want to purchase renters insurance for the apartment they share. they made a list of all of the items to be covered by the insurance policy, along with their estimated values. if the items to be covered total more than $3000, the insurance company charges an annual premium of 23% of the total value of the items. if the items to be covered total $3000 or less, the insurance company charges an annual premium of 20% of the total value of the items.

Answers: 1

Business, 22.06.2019 12:30

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 23.06.2019 03:20

With only a part-time job and the need for a professional wardrobe, rachel quickly maxed out her credit card the summer after graduation. with her first full-time paycheck in august, she vowed to pay $270 each month toward paying down her $8 comma 368 outstanding balance and not to use the card. the card has an annual interest rate of 18 percent. how long will it take rachel to pay for her wardrobe? should she shop for a new card? why or why not?

Answers: 2

You know the right answer?

More Hits Company manufactures aluminum baseball bats that it sells to university athletic departmen...

Questions

Mathematics, 20.09.2020 17:01

Chemistry, 20.09.2020 17:01

Social Studies, 20.09.2020 17:01

Chemistry, 20.09.2020 17:01

Spanish, 20.09.2020 17:01

Mathematics, 20.09.2020 17:01

Mathematics, 20.09.2020 17:01

English, 20.09.2020 17:01