Business, 29.05.2021 04:00 anytka21ovxqoa

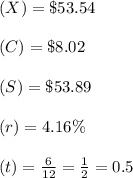

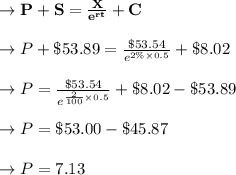

The price of a European call option on TradeX, a non-dividend-paying stock, with a strike price of $53.54 is $8.02. The TradeX stock price is $53.89, the continuously compounded risk-free rate (all maturities) is 4.16% and the time to maturity is 6 months. What is the price of a one-year European put option on TradeX with a strike price of $53.54?

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 13:10

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 15:40

Brandt enterprises is considering a new project that has a cost of $1,000,000, and the cfo set up the following simple decision tree to show its three most likely scenarios. the firm could arrange with its work force and suppliers to cease operations at the end of year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. how much is the option to abandon worth to the firm?

Answers: 1

You know the right answer?

The price of a European call option on TradeX, a non-dividend-paying stock, with a strike price of $...

Questions

Social Studies, 06.01.2020 20:31

History, 06.01.2020 20:31

Social Studies, 06.01.2020 20:31

Mathematics, 06.01.2020 20:31

Biology, 06.01.2020 20:31

Physics, 06.01.2020 20:31

English, 06.01.2020 20:31

Health, 06.01.2020 20:31

Chemistry, 06.01.2020 20:31

History, 06.01.2020 20:31