Business, 29.05.2021 02:40 YamiletRdz721

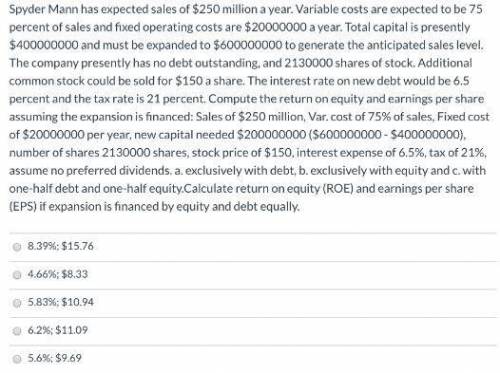

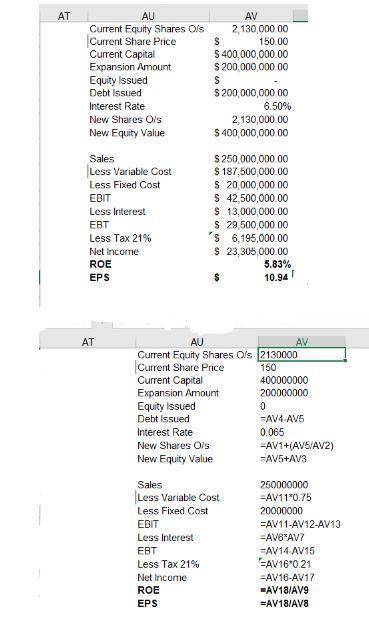

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent of sales and fixed operating costs are $20000000 a year. Total capital is presently $400000000 and must be expanded to $600000000 to generate the anticipated sales level. The company presently has no debt outstanding, and 2130000 shares of stock. Additional common stock could be sold for $150 a share. The interest rate on new debt would be 6.5 percent and the tax rate is 21 percent. Compute the return on equity and earnings per share assuming the expansion is financed: Sales of $250 million, Var. cost of 75% of sales, Fixed cost of $20000000 per year, new capital needed $200000000 ($600000000 - $400000000), number of shares 2130000 shares, stock price of $150, interest expense of 6.5%, tax of 21%, assume no preferred dividends. a. exclusively with debt, b. exclusively with equity and c. with one-half debt and one-half equity. Calculate return on equity (ROE) and earnings per share (EPS) if expansion is financed by debt.

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

When interest is compounded continuously, the amount of money increases at a rate proportional to the amount s present at time t, that is, ds/dt = rs, where r is the annual rate of interest. (a) find the amount of money accrued at the end of 3 years when $4000 is deposited in a savings account drawing 5 3 4 % annual interest compounded continuously. (round your answer to the nearest cent.) $ (b) in how many years will the initial sum deposited have doubled? (round your answer to the nearest year.) years (c) use a calculator to compare the amount obtained in part (a) with the amount s = 4000 1 + 1 4 (0.0575) 3(4) that is accrued when interest is compounded quarterly. (round your answer to the nearest cent.) s = $

Answers: 1

Business, 22.06.2019 08:40

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 17:10

To : of $25 up to 35 2 35 up to 45 5 45 up to 55 7 55 up to 65 20 65 up to 75 16 is$25 up to $35 ?

Answers: 1

Business, 22.06.2019 19:10

Do it! review 16-3 the assembly department for right pens has the following production data for the current month. beginning work in process units transferred out ending work in process 0 22,500 16,000 materials are entered at the beginning of the process. the ending work in process units are 70% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs. materials conversion costs the equivalent units of production

Answers: 2

You know the right answer?

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent...

Questions

History, 16.10.2019 19:00

Mathematics, 16.10.2019 19:00

English, 16.10.2019 19:00

History, 16.10.2019 19:00

Mathematics, 16.10.2019 19:00

Mathematics, 16.10.2019 19:00

Biology, 16.10.2019 19:00

Mathematics, 16.10.2019 19:00

Computers and Technology, 16.10.2019 19:00

Advanced Placement (AP), 16.10.2019 19:00